The US has weaponized economic sanctions in a very major way in the post-Cold War period. Heavy handed economic sanctions have been applied against several countries to include Iraq, Iran, Syria, Lybia, North Korea and now Russia. Economic sanctions were imposed on Russia in 2014 itself after its takeover of Crimea. In the build-up to the current war in Ukraine, the primary Dissuasion and Deterrence Strategy of the US and the West was the threat of imposition of very serious economic sanctions. Hence, their primary means to dissuade or deter Russia was via stringent economic sanctions and supply of defensive weapons to Ukraine.

Sanctions usually take the form of:-

• Trade sanctions.

• Energy sanctions.

• Financial sanctions.

• Sanctions on Individual companies.

• Travel sanctions.

The sanctions enforced in 2014 had caused a 5 per cent drop in Russian GDP. What were the specific economic sanction threats that were held out to deter a Russian invasion of Ukraine? These were :-

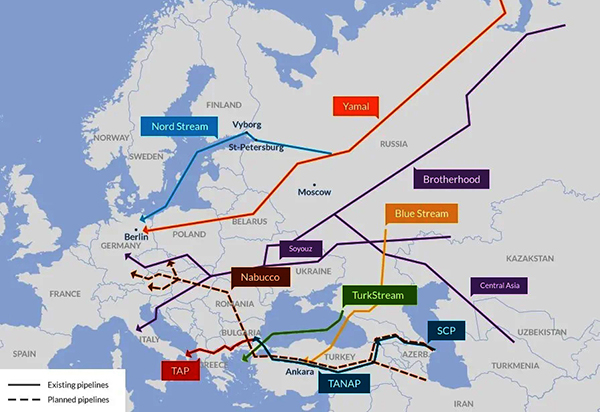

• Close Nord Stream 2 Gas Pipeline. This new gas pipeline has been constructed from Russia to North Europe (primarily to supply Germany). It was designed to bypass Ukrainian territory (where existing gas and oil pipelines were routinely being pilfered). America has been very clear to block this pipeline so that it could sell its own gas to Europe. The economics were stark. Nord Stream 2 gas would cost the Germans $270 per 1000 cubic feet. Gas from the USA would cost them almost five times at $1000 per cubic feet. Stopping Nord Stream 2 would hurt Europe badly, especially Germany and France. Germany had invested heavily in the construction this pipeline and stood to benefit the most, as in spatial terms Russian gas is closest to Germany and Western Europe. Though this pipeline was complete, it had yet to be certified. The threat was that certification would be withheld.

• Impose Full Blocking Sanctions on large Russian banks, energy companies, defence companies and oil projects.

• Freeze Russian Foreign Exchange Reserves in American and European banks (Some $300 billion worth of Russia’s total Forex reserves of $630 billion was parked in US and European banks). In a blatant breach of global trust, US and the West would simply seize these Russian Forex reserves.

• Sanction Key Russian Leaders. Key Russian leaders, Oligarchs and their families would be targeted individually for sanctions. This was supposed to hurt key decision makers in a pointed manner and ostensibly spare the ordinary Russian citizens.

• Exclude Russia from SWIFT. SWIFT – Society for Worldwide Interbank Telecommunications – headquartered in Brussels has 11,000 banks as members globally. Swift is the global electronic payment system based in Belgium. This step was deemed the equivalent of an economic nuclear strike and was deemed a last resort option. China has developed its own equivalent of Swift. It may not want to opt out of SWIFT, but if forced out or thrown out, it would not mind as it has its own viable options to supplant SWIFT. So has India, which has developed the Rupay as an option.

China as Ally for Economic War

In anticipation of these sanctions, Russia had built up huge foreign exchange reserves ($630 billion) based on the export of natural gas and oil at elevated prices and its very favourable balance of trade position. Russia had been under sanctions since 2014 and had worked out its slew of countermeasures. Putin had visited Beijing for the Winter Olympics in December 2021. The two leaders had detailed discussions and worked out a formula of “Friendship without limits”. Russia would rely heavily on China for bailing it out from the application of harsher financial sanctions. This could entail Chinese purchase of Russian oil and gas and a concerted attempt to replace the Dollar as the international currency of oil trade. China had a platform similar to SWIFT accepted in 180 countries. India has Upland and Rupay. The threat of Western sanctions, however, completely failed to deter Russia from its projected invasion of Ukraine. On 24 February 2022, President Putin announced the launch of a Special Operation with the stated aim of De-militarisation and De-Nazification of Ukraine.

The West was taken by complete surprise. Most European nations seemed convinced that Putin was merely posturing and bluffing and he would not actually cross the Rubicon. The German Intelligence Chief had to hastily flee Kiev and the French Chief of Intelligence lost his job. Surprisingly, the very first sanction came from Germany when it refused to certify the Nord Stream-2 pipeline. The UK put some Russian individuals and entities under sanctions (which the US and other countries had already done so). Most people felt that it was too little too late and the economic sanctions had failed in the primary task of deterring Russia from invading Ukraine.

Initially, the economic sanctions did seem to be making a huge impact. The Russian stock market tumbled dangerously and the Russia had to stop the trading in the stock markets and flight of capital from the country. The Rouble plummeted dangerously against the Dollar. It fell from 80 Roubles to a dollar to over 160 Roubles to a dollar. A number of Western multinational firms shut shop in Russia and moved out causing large scale dislocation and loss of jobs. The US claimed that a large number of highly qualified Russians also began to flee the country with this exodus of Western firms.

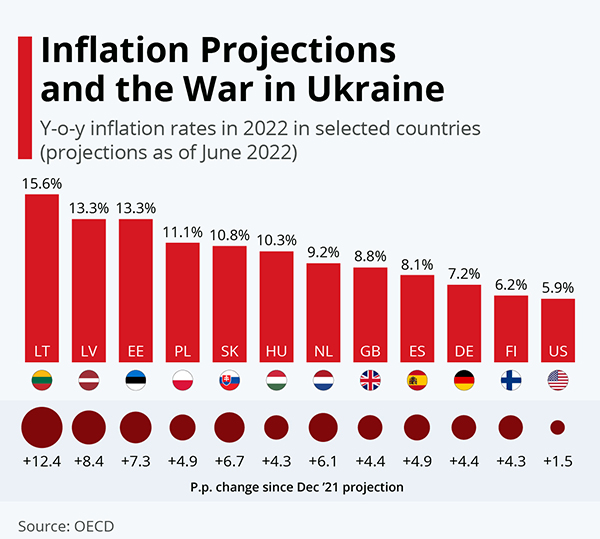

The West had weaponised its banks and financial systems to hit hard at Russia. It was a virtual act of war. It also seized over $300 bn of Russian Forex reserves in American and European banks. Inflation rose sharply in Russia from 9 per cent in February 2022; it was expected to rise to 17% by the end of the year.

Russian Response to Economic Sanctions

Russia today is the most sanctioned country in the world. It is very certain that before the launch of the Ukraine offensive, Russia must have war-gamed the economic war scenarios and come up with some response options.

Defensive Measures. Normal defensive measures against economic sanctions include:-

• Building up a Large War Chest of Forex Reserves. Russia had a built up a huge forex reserve of $630 billion.

• Capital Controls. Prevent flight of capital from the country.

• Increase Interest Rates. Russia increased these up to 20 per cent.

• Forced Capital Conversion. Force gas payments in Roubles. This was a master stroke that stopped the steep fall of the Rouble and, in fact, it came back to 80 Roubles to a dollar.

Russia well understood that Europe was badly dependent as Russian natural gas and oil, not just for heating homes but also for running its metallurgical industries like Aluminium and Copper smelting plants, etc, but also for power generation.

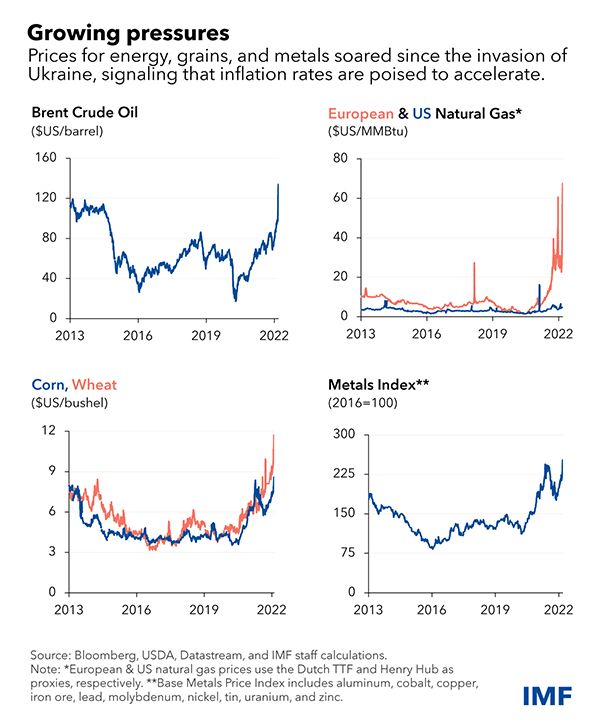

Russia was supplying almost 13 per cent of the global crude oil exports. Taking it out of the global markets suddenly was bound to have huge implications in terms of oil availability and prices. This could easily have been foreseen but strangely was not. For a time, oil prices shot up to $130 a barrel before sliding back to $100 a barrel. In fact, the steep rise in oil and gas prices themselves helped to pay Russian costs of the war. It was Europe that kept buying Russian oil and gas on the sly and contributed the most to Russia’s war chest during this conflict.

Europe imports nearly a fourth of the world’s crude oil imports. However, what is astounding is the sheer level of Europe’s dependence on Russian oil and gas. Consider this:-

• 50% of Russia’s crude is exported to Europe.

• 65% of its petrol products are sold to Europe.

• 90% of Russian piped gas is exported to Europe.

• Transportation costs are lowest for Russian gas and oil due to geographic proximity to Western Europe.

Economically, therefore, it makes no sense for Europe to impose such sanctions on Russia which would, first and foremost, hurt Europe the most.

It is just that Europe lacks the autonomy to defy American political pressure. The pain of these sanctions will hurt Europe the most. This will increase as the war drags on and one can already see an erosion in the French and German positions on conflict termination.

The American led efforts to ban all imports of Russian oil and gas suddenly has removed some 3 million barrels per day (bpd) from the global supply of crude. This was bound to have a huge adverse impact on the price of oil. For a time, oil prices shot up to $130 per barrel, before they came down to $100 and started inching upwards again. At this rate, it is feared they could shoot up to $150 a barrel and induce a severe global recession. Petrol prices started going up in the USA to over $5 per gallon. The last time they had crossed $4 a gallon was in the toxic Subprime Crisis of 2008 when the world had hit a recession.

Double Whammy. The world was emerging out of the Covid pandemic induced economic shock. The US had given a huge stimulus package and pumped in so much money that ports could not handle the ships catering to the consequent rise in demand. This was leading to huge pileup of shipments and overcrowding in ports. Now the shock of the Ukraine war is pushing the US and global economy into a stark recession. Inflation in US is at a 40-year high. $7 trillion worth have been lost on the US stock markets, which are bleeding badly.

• Nasdaq is down 28 per cent.

• Dow Jones down 12 per cent.

• S&P is down 16 per cent.

The technical companies in the US have taken a big hit and lost $3 trillion. By the ill thought through economic sanctions, the US economy itself has now taken a major hit but inflation is up at 10 per cent and GDP is down at 1.4 per cent in the first two quarters of 2022.

Impact of Biden’s Switch to Renewable Energy. It is noteworthy that Biden had stopped oil and gas extraction/production in the US to switch to renewable energy in a bid to check global warming. Thus, oil and gas supplies were already going down and prices were rising in the US even before the war in Ukraine started. Europe today stands to lose the most in this economic war. Structurally, it is very heavily dependent on Russian oil and gas. As stated, 50 per cent of Russian crude, 65 per cent of petrol products and 90 per cent of its piped gas goes to Europe to keep it warm in winter and run its power plants and factories. To delink from Russian oil and gas, Europe will need to create infrastructure that could take a number of years to come up.

Despite all talk of sanctions, European countries have continued to buy Russian gas and oil on the quiet. Russia has offered to sell oil to India and China at discounted prices. India has rightly rebuffed all Western moralising and hypocrisy on this subject and purchase of Russian energy has gone up six times. Sanctions have pushed up the prices of oil and gas and paradoxically increased Russian earnings during this war despite all sanctions. The Russian reaction to American seizure of their Forex reserves was to demand all payment for their oil and gas in roubles. This one step immediately shored up the steeply falling price of the rouble. It had fallen from 80 roubles to a dollar to some 160 roubles to a dollar. The rouble has now not only recovered and come back to its earlier value but made gains despite the lauded sanctions. In fact, today the rouble is amongst the strongest performing currencies against the dollar. The global economy was too deeply integrated and the disruption caused by sanctions on Russia has equally disrupted the Western economies also.

It is virtually a butterfly effect. A sudden attempt to put some 3 billion barrels per day (bpd) of Russian oil out of circulation has sent oil prices skyrocketing.

This steep rise in energy prices has caused high inflation in the US and Western economies. Russia has gained from this rise in the value of its oil and gas exports and has actually profited in this war.

Saudi Arabia was callously snubbed by Joe Biden for Its proximity to Donald Trump. It, therefore, refused to follow American diktats to over produce and lower the price of oil. The US now seems hoist with its own petard of sanctions.

Energy Prices Wind Fall

• Phil Rosen wrote on 16 May 2022 that soaring oil and gas prices have helped Russia more than triple its current account surplus, to $96 billion (its largest in 28 years).

• Russia today has a current account surplus of $95.8 billion in the past few months of 2022 as per Central Bank data.

• This is more than triple the $27.5 billion from the same time span last year.

• Russia oil exports revenue is up 5 per cent since the start of 2022. (As per reports of International Energy Agency) revenue from oil and gas sales as well as Moscow’s strict capital controls have helped prop up Russian rouble to the world’s top performing currency against the dollar.

So much for the disastrous impact of Western economic sanctions! Highly adverse consequences are equally visible in USA and Europe in the form of steeply rising prices of oil, gas and food stuffs and runaway inflation in America. Joe Biden is facing a crucial mid-term election with this self-induced economic shock. For all the shrill propaganda and media hype, there is now a slow and inexorable reality check that will soon be evident to this world.

Food Grains

Russia and Ukraine are both major producers of food grains (wheat, barley and maize) as also of fertilisers. Ukraine also used to export major quantities of sun flower oil.

Ukraine is the fifth largest exporter of wheat. However, today all its sea coasts are blockaded. It has lost the key ports of Sevastopol, Mariuropol and Kherson. Odessa port, from where bulk of food grains are exported, is under Russian naval blockade.

Ukraine also used to export Phosphate and Nitrogen based fertilisers. This fertiliser supply has also been disrupted. Fertiliser prices are now above $60 per 1000 cubic feet. Reduced supply of food and fertilisers could affect some 6 billion people globally. It could create severe malnutritionin the Middle East, Africa and South America. Especially countries like Somalia, Egypt, Algeria and countries in Latin America would be severely impacted. Some 2 billion humans could face malnutrition as a result of this war.

Summary of Economic Impacts

A major long term economic impact of the Ukraine war will emerge from the complete erosion of trust in global financial Institutions and global economic governance.

By grabbing some $300 bn (out of Russia $630 Forex reserves) which were parked in American and European banks, the US has severely eroded trust at the global level. This will lead to a sharp polarisation. China, India, Russia and other major economies will now think twice before putting forex reserves in American or European banks. This could spell the end of globalisation as we know it.

Impact on Russia. The cost of the Ukraine war has been almost a billion dollars per day. Paradoxically, this has been offset by European purchase of Russian oil and gas at virtually a billion dollars a day. Since the war began, Europe has contributed over $60 bn to the Russian war chest by its continued import of Russian oil and gas. The simple fact is that infrastructurally, Euopre cannot de-link itself from Russian energy supplies for at least 3-5 years more. There is also the cost of new infrastructure that will have to be created. Russia has put in place strict currency control, heightened interest rates and stopped flight of capital. Due to elevated energy prices and continual exports of oil and gas, Russia today has a current account surplus of $95.8 billion in the past four months of 2022. The Russian rouble today is the best performing currency against the dollar. The sanctions have dismally failed to deter the Russia Invasion or even slow down its prosecution of the war. The sanctions on Russia will bite only in the long term. In the short term, the US and European economies are also paying a steep price in terms of inflation caused by elevated oil and gas prices, services disruption in global food and fertiliser supply and disruption of value chains. In the long term, Russia may face a GDP drop of 15 per cent if the sanctions continue unabated. The short-term impact, however, has been quite the reverse of what was expected.

Impact on Ukraine. The toll in terms of human lives and civilian and military infrastructure has been horrific indeed. No amount of Western propaganda can paper over this painful reality. Ukraine’s basic infrastructure has been destroyed. Some 40 of its cities and towns have been razed to the ground. The war has diverted human resources from labour to the military. 6-7 million Ukrainians have been displaced internally and some 5 million have gone out as refugees to the rest of Europe. The most severe consequence has been the loss of 80 per cent of Ukraine’s coast line and all its major ports – Sevastapol, Mariupol and Kherson. Besides, the Russian Navy has blockaded Odessa. This has led to a severe choking of 90 per cent of its wheat and food grains exports and 50 per cent of its energy supplies. Ukraine has become a landlocked country and the total loss of its seaports will lead to a collapse of 40-50 per cent of its GDP.

The US and Europe have fought Russia virtually to the last Ukrainian soldier without soiling their hands. By engaging in direct combat.

Impact on Europe. The sanctions seem to have backfired rather badly on Europe. These severe consequences can be listed as:-

• Inflation. This is at 8 per cent. It had briefly touched 10 per cent. Due to Covid the fiscal space to deal with this inflation is badly restricted.

• Price of Food. This has created a global crisis that could lead to famines in the Middle East, Africa and Latin America. This is steeply pushing up inflation.

• Price of Energy. Europe is inextricably linked with Russia, as it’s most proximate source of energy. Europe has ended up paying for the Russian cost of this war due to elevated prices of oil and gas.

• Asylum Costs. There is the direct cost to ensure the housing, feeding and welfare of some 5-6 million refugees from Ukraine.

• Defence Costs. The USA has pumped is some $40 billion worth of arms aid already and more is in the pipeline. Europe is also supplying weapons, equipment and ammunition.

• Reconstruction Costs. Once the war is over there will be the huge costs of recreation of civilian infrastructure and rebuilding of devastated cities and towns.

Global Impact

• Erosion of Trust in Global Financial Governance. Severe erosion of trust in global financial Institutions and governance will lead to a collapse of globalisation or at best a sharp polarisation between East and West.

• Possibility of De-Dollarisation of Global Oil Trade. As countries are forced to pay in local currencies or in Yuans. China is paying in Yuans and India in Rupee-Rouble terms.

• Elevated Energy Prices will cause a High Level of Inflation. (6% or more). This in turn could induce a recession at the global level. Chinese economy is taking down the Asian economy (due to Covid) and the US economy could drag the global economy into a recession.

• Food Crisis & Famines. Russia and Ukraine, between themselves, were exporting the bulk of food grains (wheat, barley, maize) as also cooking oil (sunflower oil). The prices of fertilisers will also impact food prices. Due to the heat wave, India has been forced to temporarily halt food grains export. The countries of the Middle East, Africa and Latin America could be severely impacted. Somalia receives almost all food grains imported from Ukraine and Russia and will soon face a disaster. This and other countries could face famines and severe food shortages – especially in Egypt, Algeria and some Latin American countries.

• Double Whammy. Covid and Ukraine have delivered a double whammy to the global economy. Covid induced financial stimulus packages have severely curtailed the fiscal space to now deal with any global recession. The reckless eastward expansion of NATO has entrained a disastrous series of unintended consequences, which are now clearly threatening the global economy not just with recession but severe stagflation.