The defence budget for the year 2020-21 has been raised by just 5 per cent over the current year’s revised allocations, following a multi-year trend of steadily reducing the share of defence spending as a percentage of the government’s total outlay. The defence allocation for the year 2020-21 has been set at just 1.43 per cent of India’s GDP, one of the lowest in the recent years, as has been the trend under the Narendra Modi government.

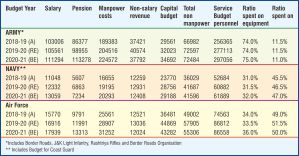

Nirmala Sitharaman, herself a former defence minister, allocated to defence Rs 471,378 crore, an increase of Rs 22,558 crore over the current year’s revised estimate of Rs 448,820 crore. This includes the outlay for revenue and capital expenditure, as well as military pensions. It works out to be 15.4 per cent of the country’s entire budget. If pensions are excluded, the defence budget was increased to Rs 3,37,553 crore, up from Rs 3,18,931 crore for the present fiscal ending March 31, 2020. This is a meagre 5.8 per cent hike.

Indian Army, Air Force and Navy which are facing a combined challenge from Pakistan and China, got just Rs 10,300 crore hike in funds to buy new arms and ammunition in the Union budget which could adversely impact their modernisation plans.

The salaries of the three Services and the civilians concerned work out to be Rs 1,34,989 crore, which now form 39.99 per cent of the budget. In other words, salaries and pensions take up more money than what is allocated for modernisation.

The forces have been demanding an increase in funds allocation to buy new weapons. The Union budget has kept Rs 10,532 crore for defence research &development.

Army

The army has got the largest hike in capital spending, but this 8 per cent rise of Rs 2,669 crore will be insufficient to pay for the artillery guns, tanks and air defence systems the army badly requires.

Indian Army was also forced to cut some expenditures to ensure that it has ammunition for at least 10 days war.

The budget has allocated Rs 32,392 crore to the Indian army for its modernisation plans against Rs 29,666 crore given in the revised budget last year.

Navy

There is disappointment for the navy. Indian Navy has been given just Rs 26,688 crore in 2020-21 budget for modernisation against Rs 26,156 crore in the revised budget last year, despite public statements from senior admirals, including navy chief Admiral Karambir Singh, seeking a larger share of the defence budget.

Without that, the navy says it will be in no position to process important procurements – such as the production of six advanced submarines under Project 75I and the building of a second indigenous aircraft carrier to follow INS Vikrant, which Cochin Shipyard Ltd is likely to deliver next year.

A shortage in funds is forcing Indian Navy to curtail its plan to be a 200 ships fleet by 2027 as per maritime capability perspective plan. It has already cut some of the acquisition including Mine Counter Measure Vessels and P8i maritime reconnaissance aircraft.

Air Force

The Indian Air Force (IAF) has again been allocated the lion’s share of the capital budget – Rs 43,282 crore, much of which will go towards instalments on earlier procurements, such as the 36 Rafale fighters that will begin delivery this year. However, this is lower than the IAF’s allocation of Rs 44,869 crore in the current year’s revised estimates.

IAF, which is in the process of buying new Rafale aircraft and also needs more fighter jets to replace its ageing aircraft, has actually seen a slight decrease in its capital outlay for modernisation.

Capital Expenditure

The capital allocation used for purchase of new weapons, aircraft, warships and other military hardware like guns and new UAVs is Rs 1,13,626 crore. This means modernisation gets an increase of Rs 10,316 crore over this year’s allocation of Rs 1,03,310 crore.

Despite the large number of weapons systems due for procurement, the capital allocation has been raised only marginally in 2020-21. That rise of less than three per cent is insufficient to even cover inflation and forex exchange rate slippages. The military will, therefore, have less buying power next year.

The government has allocated Rs 32,392.38 crore ($4.5 billion) for meeting the Indian Army’s capital expenses, of which Rs 4,000 crore ($560 million) has been earmarked for buying military aviation assets for the land forces.

The Indian Navy has got Rs 26688.28 crore ($3.73 billion) for new purchases, of which it is expected to spend Rs 12,746 crore ($1.78 billion) for building its naval fleet.

The IAF has got lesser capital allocation for the next fiscal at Rs 43,281.91 crore ($6 billion), which is already Rs 1,587.23 crore ($222 million) less than the current fiscal’s revised estimates. A major chunk, Rs 26,909.88 crore (3.76 billion), will go towards aircraft and aeroengine purchases in 2020-21.

Revenue Expenditure

The rest of Rs 209,319 crore (over $29.3 billion) will go towards revenue expenses, which is usually for meeting recurring expenses such as on maintenance of infrastructure, replenishment of existing weapons and equipment, and for capacity building. In the 2020 fiscal, under revised estimates.

Major Purchases

The Indian Army is already in the process of acquiring six Boeing Apache gunships and is negotiating the purchase with the global vendor under a follow-on order for the 22 Apaches bought by the Indian Air Force.

The Modi government had in 2016 ordered 36 Rafale combat jets from France and the deliveries of the aircraft began last October. The budget for the aircraft will go towards committed liabilities such as the Rafale purchase.

Pensions

The budget for pensions has been hiked by Rs 21,742 crore and is now pegged at Rs 1,33,819 crore. This year, a sum of Rs 1,12,077 crore is earmarked for pensions.

Worryingly, the only appreciable rise in spending is in defence pensions, for which the allocation has risen by almost 14 per cent to Rs 133,825 crore for 2020-21. This raise comes on the back of a an even larger 16 per cent raise this year, over the 2018-19 pension allocation.

Since the grant of “one rank, one pension” in 2015-16, the military pension budget has more than doubled from the level of Rs 60,000 crore in 2015-16.

To put this in perspective, India spends more on its defence pensioners than Pakistan’s defence budget (Rs 1 lakh crore this year). India has approximately 26 lakh defence pensioners and each year it adds 55 lakh pensioners to this total. Five-yearly revisions in pension – the One Rank One Pension (OROP) – granted by the government in 2015 – means that the pension burden is only set to increase.

Comments

The MoD is looking at “right-sizing” the forces and also at cutting costs within. The Army has already started the restructuring process.

The defence budget amounts to 15.5 per cent of the government’s total spending of Rs 3,042,230 crore next year. That share of government spending is significantly lower than this year’s share of 16.6 per cent, the 17.4 per cent share in 2018-19 and the 17.7 per cent in 2017-18.

With this, the plans of the armed forces for modernising their weapons and equipment with new acquisitions can take a backseat for the next fiscal at least.

In a tell-tale sign of how this defence budget is perceived, defence minister Rajnath Singh had not a single word to say about the allocation for the armed forces in his eight-paragraph statement on the annual budget itself. The statement came in the form of a text message to the media from the ministry’s official spokesperson.

The three Services have been pressing for higher allocations to carry forward their long-pending modernisation plans and go for big ticket acquisitions in view of fast changing security matrix in the region including China further boosting its military might.

The expectations for higher allocation rose after last year’s Balakot strikes. Military experts said though the allocation was inadequate in view of the demands of the three forces, the outlay was satisfactory considering the state of the country’s economy.

The military was hoping for healthy increase in defence funding as several modernization programmes have to be implemented – ranging from artillery guns and helicopters to fighters and submarines. The armed forces will have to prioritise their purchases given that the available resources are inadequate.

A parliamentary panel has asked the defence ministry to “strongly press” for additional funds from the finance ministry to enable the military to buy new equipment and also pay for weapons and systems it has already contracted to purchase, at a time when the armed forces projected a combined requirement of almost Rs 1 lakh crore more under the capital head for 2019-20.

The Army accounts for a lion’s share of the budget – over 56%. This year’s defence budget saw an increase of Rs 2,500 crore in the Army’s capital budget (when compared to revised estimates of last year’s defence budget). The IAF, in sharp contrast, saw capital budget slashed by Rs 1,200 crore.

For a nation that allocates 15.49 per cent of federal government’s total annual expenditure, India’s bid to strengthen its defence exports is rather an expectation than innovation. It only serves the country well to foresee itself excel in defence exports, especially when our net exports stands at a negative trade balance of $184 billion in 2018-19.

Taking pride in its defence capabilities, India can aspire for a larger role in defence export on the global front. Developing artillery guns, aircraft carriers, light-combat aircraft, submarines and combat helicopters will make India a manufacturing hub in defence on the global scale. The prime minister spoke of expanding the export of defence equipment to Rs 35,000 crore, at Defexpo show in February, mentioning how it had risen from Rs 2,000 crore in 2014 to Rs 17,000 in the last two years.

Boosting the Make in India sentiment for defence equipment not only decreases India’s imports in defence but also pushes its exports – which will help reduce the negative export balance. A call for defence investors is also a plus for India in the current economic outlook. Defence remains a lucrative sector and investor sentiment will be favourable despite dull economic growth that has played a pivotal role in shooing away investors and further adding to the misery of the investment-starved economy. A conducive business environment, efficient supply-chain and logistics supported by state-of-the-art infrastructure is perhaps the package which will put India in a position of advantage. Defence, then, can become a trump card. Expanding its defence exports will be a major plus for India. It will help reduce the net exports negative balance.

============

Defence, Aerospace Got Rs 1,800 cr FDI in 5 Years

Defence and aerospace sectors, the corner stones of the government’s ambitious Make in India programme, garnered relatively miniscule foreign direct investment (FDI) in the last five years.

While the country attracted FDI valued around $286 billion in the past five years across sectors, defence and aerospace, which were projected as high potential sectors under ‘Make in India’, could grab only a measly Rs 1,834 crore, according to government data released on 10 February.

The government had also announced two defence corridors – in Tamil Nadu and Uttar Pradesh. While launching the Tamil Nadu Aerospace and Defence Industrial Policy at the Global Investors Meet in Chennai in January 2019, the then defence minister Nirmala Sitharaman had said: “…by announcing the corridor, we have invited quite a lot of manufacturers from abroad to come, choose the location where they want to establish their unit and start producing defence equipment”. But the investments are still nothing worth writing home about.

As per the data furnished by 79 companies operating in Defence and Aerospace sector, so far, FDI inflows of over Rs 1,834 crore have been reported after 2014 under both government and automatic route.In May 2001, the defence sector, until then reserved for the public sector, was opened up for 100 per cent Indian private sector participation and foreign direct investment up to 26 per cent.

Further, the government later allowed FDI up to 49 per cent under the automatic route and above 49 per cent through the government route wherever it is likely to result in access to modern technology or for other reasons to be recorded.

The government had envisaged that by allowing higher FDI in the defence sector, the global companies having high-end technologies can be encouraged to set up their manufacturing base in India in collaboration with Indian companies, thereby, resulting in creation of employment opportunities, saving foreign exchange and increasing indigenisation.