Need for Autonomy, Accountability and Efficiency

Various committees have, over the years, recommended conversion of the Ordnance Factory Board (OFB) into the Ordnance Factory Corporation Limited to ensure that ordnance factories get the desired functional autonomy and make them accountable and responsible for their operations and performances.

The TKA Nair Committee (2000), Dr Vijay Kelkar Committee (2004), Raman Puri Committee (2015) and Shekatkar Committee (2016) have recommended the corporatisation of the OFB. Based on these reports and to strengthen self-reliance in defence production, the government decided in May 2020 that under the Atmanirbhar Bharat package, the corporatisation of the OFB would be undertaken to improve autonomy, accountability and efficiency in ordnance supplies.

The armed forces have regularly raised concerns about high overhead costs, inconsistent quality and delay in supplies from the OFB. Monopoly of the OFB and lack of innovation and technology development has led to low productivity. No penalties have been imposed for delayed delivery. These figures tell their own story

Production Targets and Achievements

Year Target Achievement % Shortfall

2013-14 382 163 57

2014-15 693 251 64

2015-16 580 194 67

2016-17 576 249 57

2017-18 446 220 51

Corporatisation Blues

The corporatisation of OFB formed part of the Modi 2.0 government’s ‘167 transformative ideas’ to be implemented in 100 days, ie, by October 2019. The Modi government had floated a proposal for corporatisation in Jul/Aug 2019 but the trade unions called for an indefinite strike against the decision on 20 August 2019. However, the strike was called off on 26 August 2019, after assurances by the Secretary of Defence Production that government has not taken any decision yet towards corporatisation of OFB.

The government, thereafter, set up a committee to address the concerns of the employees in September 2019 and subsequently, in November 2019, issued a press release notifying the “proposal to convert Ordnance Factories under the OFB into a 100 per cent Government owned public sector units to provide functional and financial autonomy and managerial flexibility so as to enable the organisation to grow at a faster pace and play a greater role in defence preparedness of the country while also adequately safeguarding the interests of the workers”.

ALSO READ: DEFENCE PROCUREMENT: Defence Acquisition Procedure (DAP) 2020 Released

With the finance minister’s announcement again as part of Defence Reforms package, trade unions again called for an indefinite strike calling the government decision as “arbitrary, illegal and unjustified”.

The biggest concerns of the OFB employees is that ‘Corporatisation’ is the first step towards ‘Privatisation’ and is likely to result in layoffs and job cuts. However, as of now, the Government has made it very clear that it is not thinking of ‘Privatisation’ in the near future and OFB will function akin to the various public sector undertakings (PSUs) in the country post-corporatisation.

Current Organisation

OFB is one of the oldest organisation in the country comprising of 41 ordnance factories, 13 ordnance R&D centres and nine ordnance institutes of learning, distributed all over the country at 24 different locations. It presently functions under the Department of Defence Production of Ministry of Defence and a key supplier of wide variety of products to the armed forces which includes armament, ammunition and also troop comfort items.

The OFs are managed by a three-tiered system with the DDP at the Apex, the OFB which performs the executive functions and individual factory managements. The ordnance factory board is managed by IOFS officers. The board is headed by a Director General and Eight Members. Five members of the board are responsible for functioning of each of the five manufacturing groups and three members are responsible for staff functions of personnel, finance and marketing.

The practice of appointing the senior most IOFS cadre officer as the Chairman without consideration to merit or residual service has resulted in very short tenure of the Chairman.

OFB Financial Structure. The OFB is wholly owned by the government. Budgetary allocations under capital and revenue heads are made to the OFB from the defence budget. These allocations amounting to approximately 1 % of the total defence budget for 2017-18 (BE) cater for shortfall in requirement of the OFB after accounting for income through sales. OFB is unable to run the factories and OFB from its own profits. OFB officers look at Army as their Captive Customer irrespective of shortfalls in quality, delayed supplies, costly products and indifference to complaints.

Affect of Corporatisation

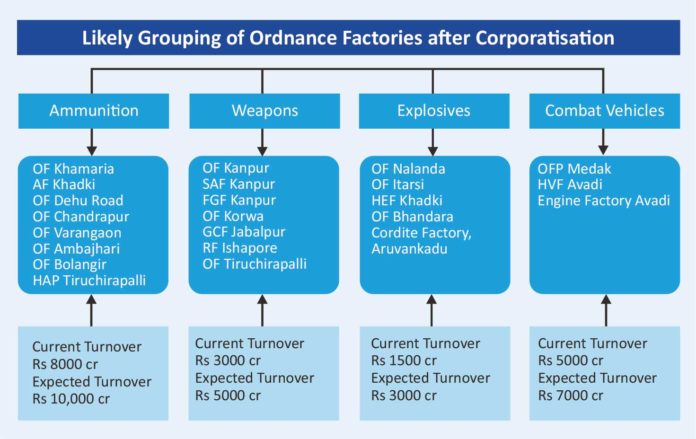

The corporatisation of OFB will put it at par with other defence PSUs managed by its own board of directors with broad guidelines from the government. The government has envisioned growth of OFB post corporatisation expecting it to raise its turnover to Rs 30,000 crore by 2024-25 annually against exiting Rs 12,000 crore, and has set up a high level panel to work out a roadmap to achieve the same. Vice Admiral Raman Puri Committee recommended grouping existing ordnance factories under three or four verticals with core competencies.

ALSO READ: Draft Defence Production and Export Promotion Policy 2020

Splitting the OFB into three or four segments and converting these into DPSUs seems to be the way forward. A likely structure categorising factories into four verticals of Ammunition, Weapons, Explosives and Combat Vehicles as shown on the table on page 54.

Post-corporatisation, OFB will be allowed to forge partnerships with the private sector as per the MoD’s approved policy and will continue to receive orders from the country’s security forces. It will also be granted a special preference of 15% above L1 price for “Make” and “Buy and Make” category products. The Centre will support OFB In case of losses, by way of loan for 30% of the total shortfall and by way of equity investment for balance 70% of the amount. The working capital for the next five years will be provided by the Department of Defence Production (DDP) as a one-time corpus fund. Capital investment for ongoing and sanctioned projects will also be provided.

Benefits of Corporatisation

Some of the prominent benefits envisaged after corporatisation are highlighted below:-

Improved Efficiency. The corporatisation of OFB is likely to result in better management of its functioning with greater autonomy in functioning and dynamic decision making, also resulting in timely delivery and better quality supplied by factories.

Competitive Pricing. At present, a cost plus mechanism is followed by OFB to fix the prices. In this system the price is fixed by taking max estimated cost plus 20 percent to cater for contingencies which are further raised by another 8 to 15 percent next year. This led to over pricing with CAG even pointing out that in some cases OFB is charging even more than the import value of the equipment. It is envisaged that corporatisation will lead to reduced and competitive pricing, since OFB will be competing with private players in defence industry, albeit with some advantages.

Flexibility in Technology Acquisition. OFB will be free to form strategic alliances with Indian and overseas companies to boost innovation and develop new products. The factories, if modernised and managed properly will be able to unlock its true potential and be the main key in ‘Make in India’ project.

Financial Independence. OFB may no longer be dependent on government for funding as it will be able to generate funds through other means like being listed on stock exchange similar to other DPSUs. This will enable it to achieve financial independence and the money can be efficiently used for modernisation, R&D and boost innovation.

Optimum Use of Idle Capacities. The idle or under-utilised capacities of the factories will be better utilised post corporatisation.

Increased Defence Export. Corporatized Ordnance factory can use the idle capacities to generate surplus production over and above the requirement of armed forces, which can be exported to generate better revenues.

Improved Equipment State. Armed forces being the biggest customer of ordnance factories are likely to benefit immensely from corporatisation with better pricing and improved product leading to an improved equipment state and better customer satisfaction.

Concerns Over Corporatisation

Some of the concerns highlighted in various forums against corporatisation of OFB are given below:-

Commercial Viability. The argument given by OFB employees is that corporatisation of OFB will not be commercially viable since there is no fixed demands by the armed forces, coupled with issues of long gaps between orders, uneconomical order quantity, and life cycle support required for 30-40 years after the introduction of equipment. However, OFB can take a leaf out of the functioning of the DPSUs, which seems to be managing these issues without any problem.

Surge in Demand during War. OFBs supposedly have some idle capacity as a war reserve, to cater for surge in demand during war, as was demonstrated during Kargil. The government will need to look into this aspect while formulating laws for corporatisation to not compromise with the logistic support to the forces during war. OFB will need to work at its maximum capacity and look for exports of its surplus capacities during peace time, which will necessitate it to become more efficient and produce world class quality to survive in this competitive world.

Major Issues Affecting OFB Productivity

Cost of Production. Ordnance Factories operate on No Profit No Loss Basis. The products are supplied at a price that includes ‘actual cost of production’. Actual cost of production is very high because all non-production expenditure is added to the pricing making the products extremely expensive. Capture consumers have no choice due to Government policies.

The cost of production includes cost of material, cost of direct labour and overhead costs. The high pricing of OFB items is mainly attributed to the high percentage of overhead costs. Overhead costs can be further divided into fixed overheads such as indirect labour, supervisory charges etc and variable overheads such as indirect stores (stores other than raw material and components), transportation, electricity, depreciation and writing off products which are rejected by DGQA etc.

Examples of high cost of products due to cost plus pricing are as mentioned in the table below.

Degree of Demand Fulfilment by the OFB. The OFB production targets are set in mutual consultation with the Armed Forces. However, there has been a shortfall in the OFBs ability to meet these targets. Details of slippages in supply of ammunition of major categories is given above.

Sub Optimal Staffing

(a) High Supervisory Costs. The OFB has a staffing structure modelled upon supervisory Government departments rather than that of an industry. This has resulted in a supervisor to industrial employee ration of 1:1.41 as against manufacturing industry standard of 1:5. Supervisory costs account for 65 % as against Industry standards of 30 % of the total labour cost of the OFB and account for 42 % of its overhead costs. Supervisory costs accounted for 67 to 73 % of the total labour cost between 2011 to 2016.

(b) Manhour Utilisation. The average man hour utilisation of the OFB has been around 127 % (Resulting in 27 % additional salary bill for over time) whereas the average machine hour utilisation has been around 75 % for the same year.