Trade, Energy, Commerce, Space and Nuclear Power May be Affected

In a joint statement, on 26 February, the United States (US), the European Union (EU), the United Kingdom (UK), Italy, Germany, France, and Canada agreed on restrictive measures that will prevent the Russian central bank from using its foreign exchange reserves to undermine the impact of the sanctions. They also decided to cut off some Russian banks from the SWIFT inter-banking system, a move meant to isolate Russia from global trade.

Society for Worldwide Interbank Financial Telecommunication or SWIFT is a messaging system that facilitates cross-border transactions in a timely manner and has become the backbone of international financial trade.

Further sanctions were be imposed on Russia by more countries, including the US in the days that followed. The sanctions imposed this time are huge and unprecedented. These are far tougher sanctions than ever before with far more participation by countries.

The United States banned Russian oil imports and Britain said it will phase them out by year end, decisions expected to further disrupt the global energy market, where Russia is the second-largest exporter of crude.

The Indian government has been reviewing the sectors likely to be hit hardest by the sanctions imposed by the USA, NATO allies, EU countries and others against Russia for its invasion of Russia and devising mechanisms to deal with the blow. The sanctions will have a harsh impact on strategically important sectors in India, especially defence.

The government has been assessing the impact on a regular basis internally through an inter-ministerial dialogue, listing out all Russian entities that are covered under American, European as well as UN sanctions.

India and Russia — and its predecessor, the Soviet Union — have long maintained a strategic relationship centred on five main aspects: political, counter-terrorism, defence, civil nuclear energy, and space.

Bilateral trade between India & Russia

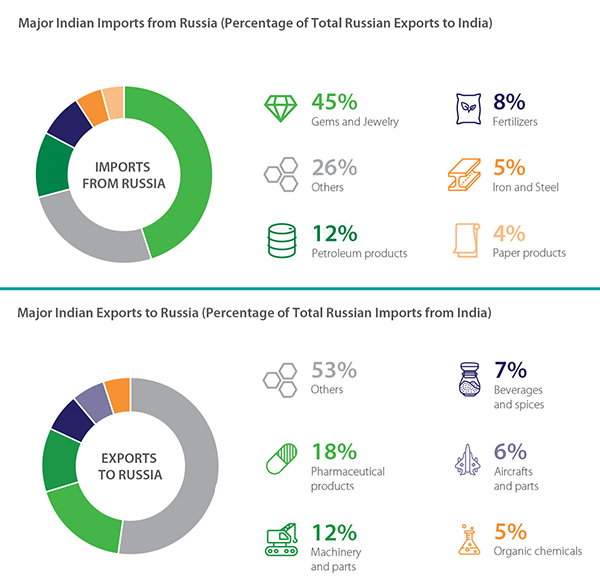

India’s bilateral trade with Russia during 2020-21 amounted to $8.1 billion. Indian exports totalled $2.6 billion, while imports from Russia amounted to $5.5 billion, according to the commerce ministry.

While India exports electrical machinery, pharmaceuticals, organic chemicals, iron & steel, apparel, tea, coffee, and vehicle spare parts to Russia, it imports defence equipment, mineral resources, precious stones and metals, nuclear power equipment, fertilisers, electrical machinery, articles of steel and inorganic chemicals, from the country.

Russia is a storehouse for all kinds of natural resources and Europe heavily relies on Moscow for imports of oil and gas, aluminium and copper and other such items. Strong sanctions are intended to achieve objectives quickly, so that they can be lifted as soon as possible.

The sanctions will not only “deeply impact” India’s defence trade with Russia, they will “adversely impact” New Delhi’s trade with Moscow when it comes to other commodities such as engineering goods, automobile components, pharmaceuticals, telecom equipment and agricultural products.

Several Russian banks have opened branches in India. These include VTB, Sberbank, Vnesheconombank, Promsvazbank and Gazprombank. Similarly, the Commercial Bank of India LLC, which is a joint venture of two major Indian banks — SBI and Canara Bank — is providing banking services in Russia.

India-Russia payment mechanism

This is not the first time that economic sanctions have been imposed on Russia. In 2014, after Russia’s annexation of Crimea, the US and other western nations imposed economic sanctions, limiting the dollar trade between Russia and the rest of the world.

In 2019, India selected Chennai-headquartered Indian Bank for transacting with Russian bank VTB for payments for their imports. The idea was that these banks would have the least exposure to the US currency. It is unclear whether Indian Bank will be used for transacting with Russia under the current sanctions.

The move to oust Russia from SWIFT may disrupt trade with India, particularly that for fertilisers, which are crucial for the country’s agriculture sector.

There is already a rupee-ruble arrangement that exists for government-to-government transactions. Therefore, that is unlikely to be affected by these sanctions and may continue for most payments.

Even in the aftermath of Western sanctions on Iran in 2012 because of its nuclear programme, India had designated Kolkata-based UCO Bank as the payment bank for Iranian oil. The account maintained deposits in euros, avoiding exposure to the US banking system.

The crisis will have an immediate effect on defence deliveries in the absence of a new payment mechanism. India has a longstanding cooperation with Russia in the field of defence.

India may consider alternative payment mechanisms for exporters if the Russia-Ukraine conflict continues for a long time and critical trade sectors such as gems and jewellery face a problem in international cash transfer. Diamonds account for about 50 per cent of India’s gems and jewellery exports. Many manufacturers have made payments in euros.

Traders could also explore using the BRICS bank for routing the bilateral trade. One public sector bank could be a nodal bank to monitor the debits and credits.

Secondary Sanctions

If secondary sanctions are activated, India will be hit the hardest. Secondary sanctions are generally imposed by the US on non-American citizens who are found to be involved in dealing with certain activities such as “assisting, sponsoring or providing financial, material or technological support for, or goods or services to or in support of persons blocked pursuant to the Executive Order”, notes US-based law firm Holland & Knight. CAATSA is an example of secondary sanction.”

Secondary sanctions carry the potent threat of cutting off the company from all business with the US or US companies. No company would ever run the risk of ever attracting secondary sanctions.

Impact on Energy Supplies

The current Russian invasion of Ukraine — unlike previous wars in Iraq and Libya or sanctions against Iran — has had an impact not just on energy prices. The effects of shipping disruptions through the Black and Azov Seas, plus Russian banks being cut off from the international payments system, are extending even to the global agri-commodities markets.

Russia is not only the world’s third biggest oil (after the US and Saudi Arabia) and the second biggest natural gas (after the US) producer, besides the No. 3 coal exporter (behind Australia and Indonesia). It is also the second largest exporter of wheat. The US Department of Agriculture (USDA), in its most recent report on February 9, estimated the country’s shipments for 2021-22 (July-June) at 35 million tonnes (mt), next only to the 37.5 mt of the whole of European Union.

At No. 4 position in wheat exports, after EU, Russia and Australia (26 mt), is Ukraine, at 24 mt. Ukraine, moreover, is the world’s third largest exporter of corn/maize, with a projected 33.5 mt in 2021-22, after the US (61.5 mt) and Argentina (42 mt). Ukraine and Russia are also the top two exporters of sunflower oil, at 6.65 mt and 3.8 mt, respectively in 2021-22, as per USDA. If that weren’t all, Russia and its next-door ally Belarus are the world’s No. 2 and No. 3 producers of muriate of potash (MOP) fertiliser, at 13.8 mt and 12.2 mt in 2020, respectively, behind Canada (22 mt).

It should not surprise, therefore, that Russia’s war on Ukraine did not stop at driving up Brent crude to $110-15/barrel and international coal prices to unprecedented $440/tonne levels. The shutting down of ports in the Black Sea also sent prices of wheat and corn traded at Chicago Board of Trade futures exchange soaring to their highest since March 2008 and December 2012, respectively.

Coal imports

India’s coal imports from Russia in March could be the highest in more than two years as Indian buyers continue buying the fuel from a market that is now increasingly isolated by sanctions.

Russia, usually India’s sixth largest supplier of coking and thermal coal, could start offering more competitive prices to Chinese and Indian buyers as European and other customers spurn Russia because of sanctions. Trade could also be boosted by a rouble-rupee trading arrangement.

Russia has urged India to deepen its investments in the sanction-hit country’s oil and gas sector, and is keen on expanding the sales networks of Russian companies in Asia’s third-largest economy.

Russia’s oil and petroleum product exports to India have approached $1 billion, and there are clear opportunities to increase this figure

Indian state-run companies hold stakes in Russian oil and gas fields, while Russian entities including Rosneft own a majority stake in Indian refiner Nayara Energy. Some Indian companies also buy Russian oil.

What does that mean for India?

Skyrocketing global prices have made Indian wheat exports very competitive and in a position to at least partially fill the void left by Russia and Ukraine. Wheat from Gujarat, Rajasthan and Uttar Pradesh were being delivered by rail wagons or trucks at warehouses near Kandla port at Rs 2,400-2,450 per quintal, as against Rs 2,100 hardly 15 days earlier. This was above the government’s minimum support price (MSP) of Rs 2,015/quintal for the new crop that will arrive in the markets from mid-March.

The Ukraine crisis has also led to prices of vegetable oils and oilseeds skyrocketing. That includes not just sunflower and its immediate competitor, soyabean. Palm oil in Malaysia has hit all-time-highs, even scaling 7,000 ringgits-per-tonne levels. The benefits of it should flow to mustard growers in Rajasthan and UP, who are set to market their crop in the coming weeks. Mustard prices are ruling at Rs 6,500-plus per quintal, which is again above the MSP of Rs 5,050.

Brent at $110-115/barrel is also helping lift the prices of cotton (because of synthetic fibres becoming costlier) and agri-commodities that can be diverted for production of ethanol (sugar and corn) or bio-diesel (palm and soyabean oil). High prices (above MSP) and a good monsoon (hopefully) can act as an inducement for farmers to expand acreages under cotton, soyabean, groundnut, sesamum and sunflower in the upcoming kharif planting season. That will serve the cause of crop diversification – especially weaning farmers away from paddy, if not sugarcane.

But there is a flip side. The ongoing Black Sea tensions are impacting fertiliser prices as well. Take MOP, a nutrient that India wholly imports. Out of the total 5.09 mt that was imported in 2020-21, nearly a third came from Belarus (0.92 mt) and Russia (0.71 mt). With supplies from there virtually choked, more quantities would have to be procured from other origins such as Canada, Jordan and Israel.

International prices of other fertilisers (urea, di-ammonium phosphate and complexes) and their raw materials/intermediates (ammonia, phosphoric acid, sulphur and rock phosphate), too, have gone up in the past one month and more. These commodities essentially track crude and gas prices. It doesn’t help when China is also India’s largest supplier of urea (Ukraine was No. 3 in 2020-21, after Oman) and second largest of DAP (after Saudi Arabia).

In short, the challenges that Ukraine will present in the coming days are going to be vastly different from those in the aftermath of Corona. And this war and the associated sanctions are also different from those experienced vis-à-vis Iraq, Libya and Iran. The effects are not confined to oil.

Space Cooperation

India’s dependence on Russian space technology has reduced over the past few decades, but the two countries continue to collaborate through the Indian space agency, ISRO, and its Russian counterpart, Roscosmos.

ISRO’s first group of four astronaut candidates for the planned crewed Gaganyaan mission completed their training for spaceflight in Russia in March 2021. It’s unclear how the war in Ukraine will affect ISRO’s plans.

The four candidates underwent their year-long training at Gagarin Research & Test Cosmonaut Training Center (GCTC) in Moscow, beginning in February 2020. Their training continued through the pandemic, concluding in 2021. Subsequently, they returned to Russia for spacesuit prototype testing.

In 2019, ISRO also announced a Technical Liaison Unit (ITLU) in Moscow to “enable effective technical coordination for timely interventions on diversified matters with Russia and neighbouring countries for realisation of the programmatic targets of ISRO”. ISRO ITLUs already reportedly exist in Washington DC and Paris.

Nuclear Power

In 2009, the two countries entered into a major nuclear deal, with Russia agreeing to install four nuclear reactors at Kudankulam in Tamil Nadu, and one in West Bengal. Two units at Kudankulam are currently operational, and the third and fourth units are being prepared for installation. Russia is also aiding with the ongoing construction of the fifth and sixth units.