Covid-19 pandemic continues to disrupt businesses, international trade, economy and supply chains across the world in addition to adverse impact on day-to-day lives of the global population.

The World Health Organisation (WHO) declared the outbreak of the disease COVID-19 due to Corona virus as a Public Health Emergency of International Concern on 30 January 2020. On 11 March, COVID-19 was declared as a pandemic. The UN Department of Economic and Social Affairs (DESA) has analysed that the global economy could shrink by up to 1% as opposed to a growth of 2.5%3 before this crisis hit the world. There is high possibility that it may reduce even further if restrictions such as lockdown continue, and governments do not provide financial support.

The Ministry of Finance, on 8 April 2020, released an order listing spending and cash flow management of each ministry. For the Ministry of Defence (MoD), the order has put a cap of 20% to defence capital, defence services and defence pensions. This means that only 20% of the budget can be spent in the first quarter of 2020-2021 (April to June).

On 27 March 2020, Society of Indian Defence Manufacturers (SIDM) organized a webinar with MoD for the Indian industry. The panel included Defence Secretary, Secretary (Defence Procurement), Directorate General (Acquisition), CMDs of the nine defence public sector undertakings (DPSUs) and Master General Ordnance (MGO) amongst others. In the webinar, DG Acquisition shared that a general order for all capital acquisitions has been published for extension of submission of bids, RFI, EoI, etc. MGO stated that all trials have been frozen and no new trials shall begin until the situation changes for the better. DPSUs were advised to ensure Industry that payments are made to all industry with preference to MSMEs. MoD urged the industry to support in fighting COVID-19 by providing ventilators, personal protective equipment and any other products for the same.

Indian Armed Forces and civil administration have been running quarantine and isolation facilities in the country. In order to speed up the procurement of supplies for these facilities, MoD has invoked emergency powers which will provide three important exemptions in the existing procurement rules. These are exemption from long-drawn bidding procedure, dispensation of procurement from Government e-Marketplace (GeM) and making 100% advance payment to suppliers after due diligence – to procure necessary supply in the fastest possible manner.

An amount of Rs 50,000 crore has been provided to National Bank For Agriculture & Rural Development (NABARD), Small Industries Development Bank of India (SIDBI) and National Housing Bank (NHB) to meet the needs of agriculture and the rural sector, small industries, housing finance companies, NBFCs and MFIs. RBI has announced that Non-performing Assets (NPA) norms of 90 days have been relaxed. The period of moratorium will be excluded from the 90-day classification norms of NPAs for those accounts, which would avail the moratorium facility. Non-Banking Financial Companies (NBFCs) have been given flexibility for relief to their borrowers.

Impact on Indian industry

Since the lowdown period in India has started, no production or less than 10% production is being done on the shop floor so far. Even with relaxation from 20 April 2020, return of workers and staff who have gone to native places or are unwilling to travel will be difficult to manage. Workforce limitation is major challenge as industrial areas are away from housing areas and people have to consider their safety of travel. At the same time, migrant workers/ labour will re-join after 3-4 months and there is a chance of skillset loss and deviation in quality of products in the initial period before everything streamlines.

Many Indian companies keep inventory for 3 months of future production, thus the challenge of limited supply is currently addressed. However, if the global situation does not ease by June, then manufacturing industry will start to feel the burden of raw materials and bought out items necessary for production.

There is significant insecurity in the industry as budget priority, policies and strategy focus will change for at least next two years and many on-going capital acquisition plans will be deferred indefinitely. As economy dips, health and infrastructure will get priority over other sectors. Specifically, for the Aviation industry, this will either be a short term “V-rise” or a long term “U-recovery”. With thorough applications of stringent A&D quality standards, with BCP being a critical requirement, maintenance and upkeep of facilities is manageable remotely with minimum human intervention. By July-Aug production/ utilisation levels may reach 70% and only after September it is expected that there will be 90-100% utilisation. This is subject to rate of growth of Covid-cases.

Aerospace demands long cash flow cycle (at least a 6-month credit cycle). Presently, finance institutions are providing support only for 2 months. There needs to be an extension to match the cycle of the sector for at least 6 months if not more. Additionally, lower rate of interest for borrowing is vital for achieving international competitiveness. Similar sized company in Thailand may borrow at 7-8% vs. aerospace MSME in India which borrow at around 12%.

While the outbreak of Corona virus has created a situation of uncertainty and apprehension for every organisation, Micro, Small and Medium Enterprises (MSMEs) are the worst affected. Then nation is striving to follow prime minister’s appeal of not dismissing employees and continuing paying salaries. However, MSMEs, especially those with weak balance sheets, are finding it difficult to retain employees.

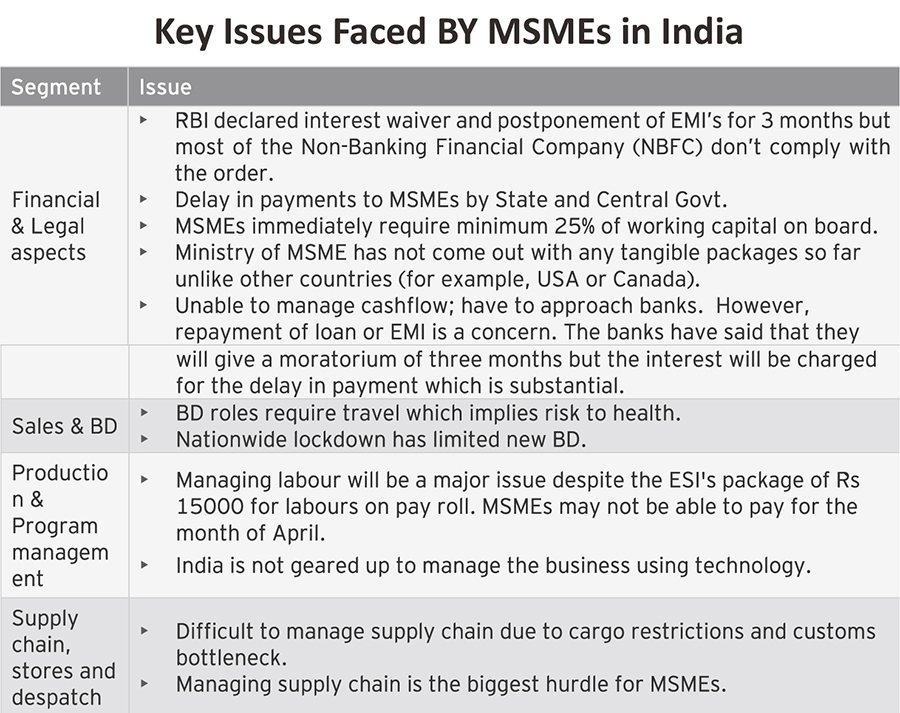

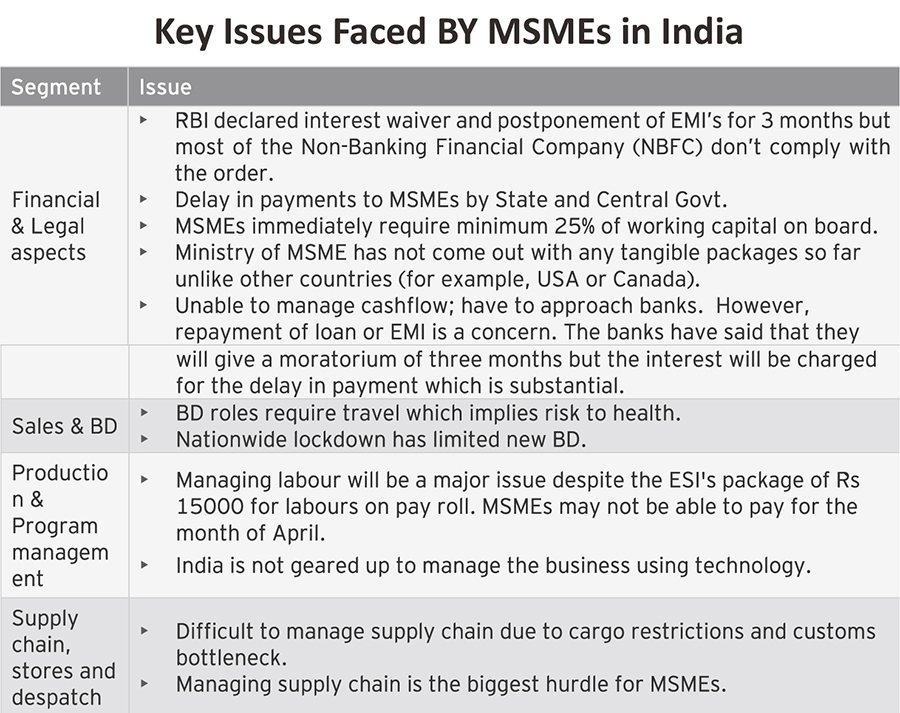

Key issues that MSMEs in India are facing today are tabulated in table above.

Anticipated post lockdown scenario in India

Discussions with Indian industry involved in defence manufacturing has also brought out the following projections:

• It is anticipated that due to complete halt of all activities, the problems of cash flow, raw material prices and logistics problems will arise after lockdown is over.

• It appears that complete revival of any MSME shall require at least 6-12 months.

• Most of the MSMEs are very disturbed and there is feeling that 40% of the MSMEs will be wiped out in three months’ time unless Government comes out with a major package.

• Prices of raw material are expected to increase. Already suppliers have started reaching out for price increase due to low supply high demand situation on certain consumables or raw material.

• Raw material prices, due to dependency on China are bound to increase and as always would be passed on to the end users.

• Marginal increase in prices of products (approximately 3-4%) unless imported.

• Transportation will not be a problem after lockdown.

• Most of the factory workers are migrants from villages or other states. Many of them may not return after the lockdown. So MSMEs will have to recruit fresh employees and train them. Cost of wages and salaries will rise. Labour unrest can also be a threat. Hence, getting raw materials shortage can hamper production.

• Increase in cost of all raw materials, labour costs and import costs will increase final product cost, reduce profits and many MSMEs will be out of business if government doesn’t give encouragement and incentives.

Other industries such as tourism and aviation are also at a standstill since almost 100 countries have closed national borders in the last month. Even after these restrictions are lifted, the demand for new aircrafts will be low since practice of social distancing will continue. People will refrain from travelling unless very essential.

The entire world is putting in efforts in any and every way possible to restore normalcy slowly and gradually. It has become prudent for governments to shift their focus inwards. Countries will concentrate on reviving their economies and restrain from nefarious activities. Since conflict will reduce, demand for military arsenal will also reduce. As a ripple effect, global trade will reduce, export of defence products will not increase because of reduced demand.

Exit Strategy

Today, though the world might debate on Covid-19 being a conspiracy, it is unified against China for not containing the Corona virus and lack of information it provided to the world. Consequently, international trade towards China will experience a dip but the sum total trade will remain the same. According to US-India Strategic and Partnership Forum (USISPF), around 200 companies are seeking to shift their manufacturing from China to India. USISPF also said that to attract these companies, India needs to introduce reforms, be more transparent in the process and engage more. Other countries like South Korea and Japan are also seeking to move their factories to India from China. Andhra Pradesh is under consideration by companies like POSCO and Hyundai Steel. Japan has also been reported to spend $2.2 billion help companies to shift out of China.

These series of event present themselves as a golden opportunity for India to become a leading manufacturing hub and attract large foreign investments. This will also aid India to accelerate the revival of its economy in the near future along with giving a boost to Make in India. India has lost a window for abundant development when USSR split. India did not capture the moment like shipyards such as Fincantieri and Daewoo which came up since they employed jobless people and tapped into the market in the right time. Ruble fell to unprecedented low and India did not cash on it. Therefore, India cannot miss this prospect. The Industry ministry, Finance ministry and Commerce ministry are in process of developing a package to attract companies planning to exit China. Tax and duty incentives, fast track clearances both at central and state levels with single window clearances where possible, easier availability of land, relaxations from too many regulations if the planned factory is in a SEZ are a few suggestions to be included in this package.

To take full advantage of this situation India must focus on quality, cost effective products in an innovative way. Companies need to focus on digital strategy, embrace change, build strong digital fluency, focus on automation and establish single interface for multiple function for agile response. If a company is not online, it is time to have a digital presence. This is the time organisations have to know more about their clients, their buying patterns, why are they buying from a particular source and what is the unique value that source is creating or selling. As of now, it is unclear, how many companies have reviewed their sales pattern data by demography, channel etc. Any organisation needs to understand the customer, and this is the right time to take up this task by conducting interviews/calls and asking their opinion about the products and identifying the gaps based on their feedback. Introducing key team members to customers especially sales, marketing, finance and support leads is another need of the hour. This is the time where companies need to establish metrics and start measuring. They need to create product awareness, new leads, new signup, referral programs and identify churn rate.

There is no contention in the fact that government is the single buyer of defence products in India. MoD needs proactively engaging with industry by placing orders. If this is not done, problems like cash flow and unemployment will rise leading to a hungry work force and in turn an angry work force. Problems in hinterland is the last thing a government wants.

As far as the issue of financial resources for procurement from industry is concerned, it is important to realise a way so that military modernisation does not take a hit. Capital defence budget consists not only of modernisation but also land, construction work etc. The 20% cap should be enforced on the budget outlay for such segments without hampering military modernisation. On the revenue side, a 30% cap has been indicated. In these times, there is no troop movement hence less fuel consumption, no military/international exercises. The only major negative impact is that no training can be conducted. However, this loss of training in quarter 1 and 2 of 2020 will be offset by rapid training schedule fitted in the curriculum in the next 2-3 quarters. Hence, operational efficiency shall not be affected.

If India wants to save its MSMEs, MoD should ensure placement of direct offsets on MSMEs and give up wasting offset credit value to be given to OEMs abroad for non-productive items like buying land in Defence Corridors, establishment of test facilities, ToT, etc., (and most of them with offset credit multiplication factors). Direct offsets should only be resorted to and not indirect offsets as has been proposed under new DPP-2020.

Courtesy: E&Y Report

[…] ALSO READ: Impact of COVID-19 on Aerospace & Defence MSMEs […]