The Ministry of Defence (MoD) signed an Rs 880 crore ($117.8 million) contract with Israel Weapon Industries (IWI) on 19 March for 16,749 Negev NG-7 7.62×51 mm light machine guns (LMGs) for the Indian Army (IA).

The Negev NG-7 was ordered after numerous setbacks in procurement – including at least one tender cancellation – under the Fast Track Procedure (FTP) initiated in May 2019 under Defence Procurement Procedure-2016 (DPP-2016) to meet the IA’s 11 year-old demand for a new LMG.

The select-fire IWI Negev NG7 light was first introduced in 2012. The general-purpose machine gun has a weight of 17.41 pounds, and is chambered in the 7.62x51mm NATO round. It has two operation modes, including semi-automatic and fully automatic fire, and it is fed by either a 100- or 125-round assault drum magazine. The NG7 (NG stands for Next Generation) is used by the Israel Defense Forces as well as many operators around the world.

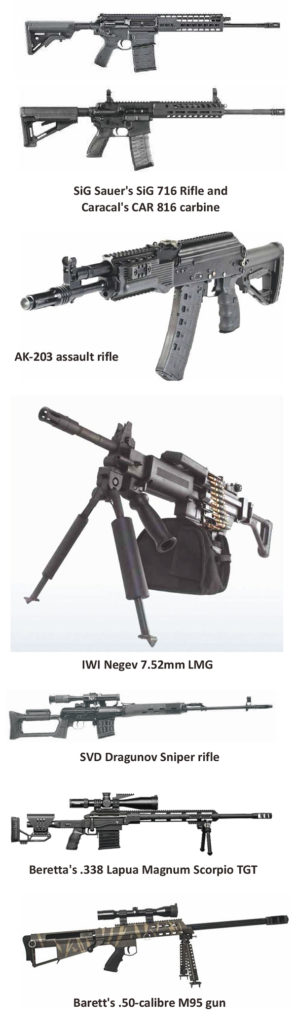

SIG Sauer 716 Rifles

The MoD signed a contract, on 12 February 2019, to get 72,400 new assault rifles from US arms-maker SIG Sauer, under the fast-track procurement (FTP) route, in the first such basic infantry weapon procurement after well over a decade. Supplies have begun to replace the indigenous INSAS assault rifles.

Off these rifles, 66,400 are meant for the Army, 4,000 for the IAF and the rest 2,000 for the Navy. The rifles, chambered for the 7.62×51 mm round (bullet), are being used by the US forces as well as several other European countries.

The overall requirement of the armed forces, primarily the 13-lakh strong Army, is for 8.16 lakh new 7.62mm calibre assault rifles. The number for the CQB carbines, in turn, is 4.58 lakh.

The defence ministry had issued the RFPs (request for proposals) for the limited number of assault rifles and carbines, which will equip soldiers deployed along the borders with Pakistan and China, under the FTP route in March 2018.

AK-203 Rifles

The foundation stone for the Ordnance Factory Korwa in Amethi was laid by the prime minister on 3 March 2019. The factory will manufacture AK-203 assault rifles, which is the latest derivative of the legendary AK-47 rifle. India will manufacture 750,000 of these assault rifles. The rifles would replace the existing India-made INSAS assault rifles in the Army, Air Force, and Navy.

After the rifles are supplied to the defence forces, the government, in the next phase, would provide them to paramilitary and the state police forces.

Caracal 816 Carbines

The Indian Army is now waiting for the close-quarter-battle carbines (CQB). UAE based Caracal Company was declared L1 after extensive trials for a $ 553.33 million. The new carbine will replace the 9 mm Sterling carbines which are being gradually phased out.

The CQB carbines for the infantry arm of the Indian army are coming through the Fast Track Procurement (FTP), just like the LMGs. The Indian Army is looking to buy 93,895 CQB carbines.

Caracal Company is NATO compliant and has been supplying these CQB carbines to other armed forces across the globe. The trials for the India market were extensive in nature and had been carried out in India as well the home country of the companies who had bid for this order. The tests were carried out with Indian ammunition in different terrain.

Caracal carbine is based on the AR-15 lightweight semi-automatic rifle. the rifle weighs 3.4 kg, and uses the 5.56 x 45mm NATO cartridge, and has a firing rate of 750-950 rpm. The 5.56 has a much higher bullet velocity and performs as well as the 7.62mm round used in the AK-series of assault rifles. Since it’s much lighter than the 7.62 or the currently-used Sterling 9mm weapons, it will lighten the Indian soldier’s load out.

Sniper Rifles

The Army was planning to buy 5,720 sniper rifles and 10.2-million rounds of ammunition, which would have cost Rs 1,000 crore ($140 million), for its Special Forces and Infantry battalions deployed on Line of Control (LoC).

The new rifle will replace the Indian Army’s ailing Soviet-era Dragunov guns. Army snipers have been using the obsolete Dragunov since it was first inducted in the Indian Army back in 1990. The weapon’s ammunition has become expensive and there have been reliability and ability problems.

But the requirement has been pruned down to 1,800 rifles and 2.7 million rounds.

To meet its urgent requirement, the Indian Army’s Udhampur-based Northern Command has already bought around 30 of two new advanced sniper rifles-Barrett M95 .50 BMG and Beretta Scorpio TGT along with .338 Lapua Magnum ammunition through special powers of the Army Commander.

Size of Small Arms Market in India

The small arms market in India is projected to grow to US$220.21m by 20221. This would be largely driven by procurement of new arms for the armed forces and other law enforcement agencies as well as upgrade of the existing inventory. Growing at a 4% Compounded Annual Growth rate (CAGR), the small arms market is expected to improve further. This is because the current small arms inventory of the armed forces is either getting exhausted or is nearing their useful lives.

The military small arms market, estimated to grow at a CAGR of 4.17%, forms a significant portion of the demand.

There is a need for next generation assault rifles, carbines, precision rifles and light machine guns. As part of Future Infantry Soldier as a System (F-INSAS) program, the intent is to equip the armed forces with modern and more efficient weapons. The presence of threats from across the borders also requires upgradation of states’ police force and central law enforcement agencies weaponry, whose market is expected to increase at a CAGR of 4.17% by 2022.

Though multi domain operations may be required to fight wars in the future, the primacy of the soldier on the ground will remain. Therefore, it is essential to equip the soldiers with modern equipment. There is a need to meet the demand indigenously and make the regulatory processes liberal without compromising on the core aspects of security. The government as well as public and private sector industries are taking steps to achieve this objective.

Policy Regulations

Policy-related changes have, off late, been fast tracked and made more inclusive to ease regulatory burden and to promote defence manufacturing and ease of doing business.

The policy changes, especially related to the arms and ammunition segment, have been introduced with the intent to create an indigenous defence manufacturing ecosystem while also encouraging foreign investments into the sector.

Relaxations in the defence products list The MoD announced in January 2019 a list of defence products that would require a defence industrial license (IL). All other items, including any parts and components that are not mentioned in the list can be manufactured without the IL. This relaxation would ease stress on Indian companies to manufacture products.

Industrial Licensing Provisions

The MoD has relaxed the validity of ILs from three years to 15 years with a provision to further increase the validity by three years on a case-to-case basis. Also, under the Arms Rules, the validity of licenses granted for arms manufacturing has now been increased to the entire lifetime of the company, subject to conditions like:

• The licensee should set up a facility for manufacture and/or proof test of arms and ammunition and conducting their trial runs, within a period of seven years from the date of grant of a license.

• The licensee has also been permitted to have enhanced production capacity up to 15% of the quantity originally approved under the license by giving only a prior intimation to the licensing authority in this regard6.

Export and Import

Appendix 3 of Schedule 2 of Indian Trade Clarification based on Harmonized System of Coding (ITC (HS)) Classification contains the SCOMET List (Special Chemicals, Organisms, Materials, Equipment and Technologies), which covers dual use goods (civil and military applications), services and technology for exports. It also regulates the exports of defence products. This comprehensive list of items are either prohibited or require an authorization for export due to the potential risks they carry when used. The updates, among others, include the addition of a new category, Category 8, which caters to “Special Materials and Related Equipment, Material Processing, Electronics, Computers, Telecommunications, Information Security, Sensors and Lasers, Navigation and Avionics, Marine, Aerospace and Propulsions.”

FDI limits

The government has already permitted Foreign Direct Investment (FDI) up to 49% in the defence sector under the automatic route. Foreign investment beyond 49% has been permitted through government approval in cases that result in access to modern technology for the country.

DRDO and OFB

The Armament Research and Development Establishment (ARDE) is Defence Research and Development Organisation (DRDO)’s primary research lab for research and development (R&D) in conventional armaments. ARDE has developed weapons including the 7.62mm Ishapore Self Loading Rifle, Indian Small Arms System (INSAS) 5.56x45mm caliber rifles, light machine guns and 40mm under barrel grenade launchers (UBGL) for INSAS and AK-47s. Besides this, it is in the process of developing a multi caliber weapon through which ammunition of various calibers can be fired by changing the barrel assembly. The laboratory is also developing a corner shot weapon system that will allow its operator to see and attack an armed target without being counter attacked.

The Ordnance Factories’ list of small arms includes revolvers, pistols, sporting rifles, pump action guns, INSAS 5.56x45mm rifles, Ghatak 7.62x39mm rifles and Excalibur 5.56x45mm rifles. OFs also launched 5.56x30mm JVPC Alpha Carbine, 7.61x51mm assault rifle and an 8.64x74mm sniper rifle at the DefExpo 2020.

Private Sector in Small Arms

The private sector is also making efforts to increase indigenization both technologically and economically. Some such entities that are working towards the development of small arms include:

SSS Defence has built sniper platforms for cartridges of two sizes (7.62 x 51mm and .338 diameters), an assault rifle (7.62 x 39mm caliber) and a close quarter carbine platform. The company’s small arms production facility is expected to be operational soon with a manufacturing capacity of 75,000 per year.

MKU had signed a Memorandum of Understanding (MoU) with a foreign company in April 2018 for strategic co-operation for manufacture of advanced Caracal Assault Rifles (CAR) 817 AR rifles in India. In April 2018, it signed two MoUs with Thales for strategic co-operation in development and production of optronic devices and F90 close quarter battle (CQB) rifles.

Jindal Defence group announced its foray into small arms manufacturing in India via a joint venture (JV) with a Brazilian company, Taurus Armas. The agreement proposes to set up a plant at Hisar (Haryana).

The Adani Group entered the small arms industry with the acquisition of a JV which is between an Indian and an Israeli company and the facility is designed to manufacture weapons including Tavor assault rifles, X-95 assault rifles, Galil sniper rifles and Uzi sub machine guns.

Way Forward

A way forward for the industry includes progression towards having

• an aggregated standardized demand for specific operational requirements

• Reduced procurement lead times

• Signed long-term agreements with company thereby assuring a streamlined order base and infrastructure investment.

While R&D continues to be a primary focus area for any technological development, it is important that all the stakeholders including government, private industry and the academia to work together.

===============