Oil prices spiked as tensions in the Middle East flared after the US strike near Baghdad international airport that killed Gen Qassem Soleiman, the Iranian general who led the Revolutionary Guards’ Quds force. Oil futures in New York and London surged as much as 3% after the attack.

International oil prices soared by $3 a barrel and the rupee weakened 44 paise to 71.81 against the US dollar on 3 January, amid concerns that the US-Iran tension could adversely impact the Indian economy, which is showing early signs of bottoming out.

The killing of the top Iranian general made stock markets nervous and the Sensex closed 162 points, or 0.4%, lower at 41,465, after dropping over 286 points during intra-day trade. The weakness in stock indices made gold more attractive as investors rushed to safety.

The strike escalated an already tense three-way situation between the US and major oil producers – Iran and Iraq. The two Middle East countries combined pumped more than 6.7 million barrels a day of oil in December, more than one-fifth of OPEC output.

Iraq is the second-largest producer in the Organization of Petroleum Exporting Countries (OPEC), pumping 4.65 million barrels a day last month. It’s immediate neighbors – Saudi Arabia, Kuwait and Iran – together produce about 15 million barrels a day. Most of their exports leave the Persian Gulf through the Strait of Hormuz, a narrow waterway that Iran has repeatedly threatened to shut down if there’s a war.

Indian Reaction

The US elicited a cautious response from India as it again called for restraint. India expressed concern over the security situation in the region, saying increase in tensions had alarmed the world and that peace and security in the region were of utmost importance.

India has been put in a very difficult position by the US strike. While India has drastically cut down its crude imports from Iran under US pressure, neighbouring Iraq has emerged as one of its top energy suppliers and any military escalation in the region could hurt India’s supplies.

India’s reaction was in keeping with its traditional bilateral and transactional approach.

Effect on Indian Economy

Any escalation of tensions could have far-reaching implications for India’s energy security and the fate of some 8 million Indian expatriates in West Asia.

The spike set off worries over an extended spell of market volatility hitting consumer sentiment by pushing up fuel prices and blunting the government’s efforts to revive the pace of economic growth.

As the world’s third-largest buyer of oil, India is vulnerable to tensions in the Middle East on two counts. One is of course the price factor and its impact on the country’s economy and consumer sentiment. The second is the possibility of supply disruption, in which case the country will have to spend more on supplies from alternative sources. But here too, things boil down to money matters.

For the government, higher oil prices mean less fiscal space for freebies or grand social sector schemes needed to revive a sagging economy.

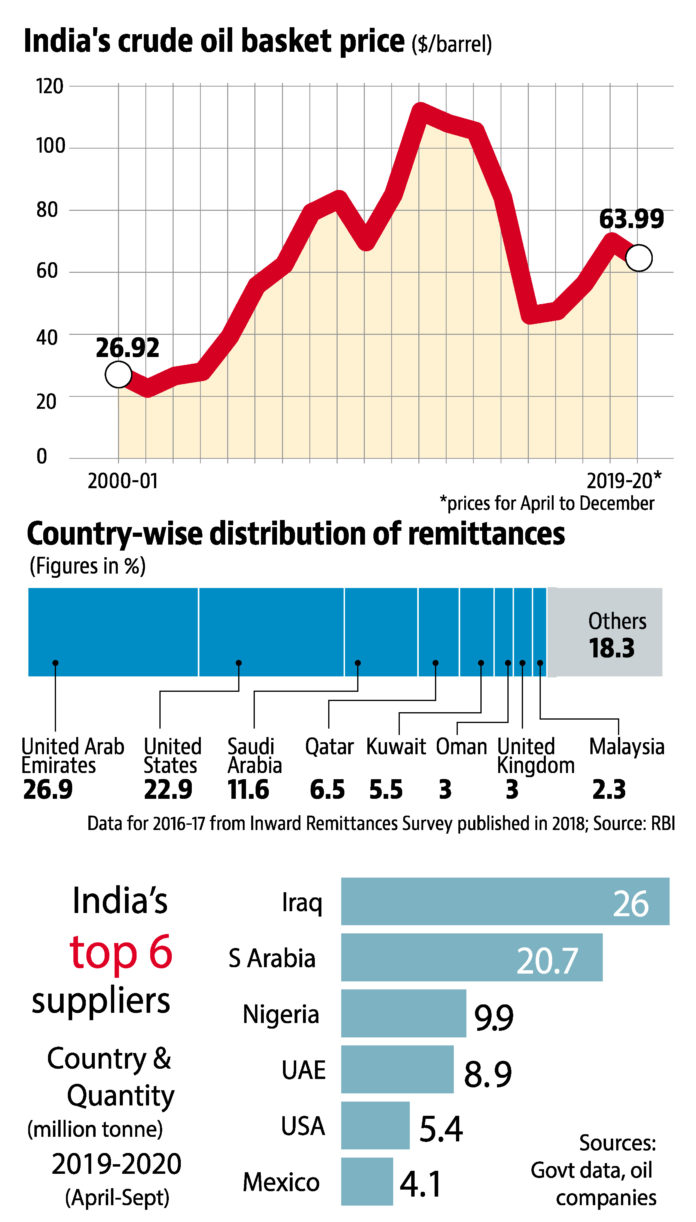

The Indian economy has enjoyed a relatively benign oil price environment in the last four years. After staying above $100 per barrel from 2011-12 to 2013-14, India’s average crude oil basket (COB) price fell to less than $50 per barrel in 2015-16 and 2016-17 and has been $56 per barrel and $70 per barrel in 2017-18 and 2018-19.

At a time when headline inflation numbers have been rising due to a spike in food prices, an oil price rally could add to the inflation surge at the present juncture. Almost 60% of India’s oil imports come from West Asia, with a negligible amount from Iran.

A rise in oil prices would also affect the current account deficit, as oil import bill will increase significantly. India imports almost 80% of its crude oil requirements. What will compound this problem is a fall in the rupee’s exchange rate.

Remittances from Middle East

Indian nationals in West Asia account for about $40 billion of the $70 billion that the country receives in remittances annually, and any conflict could hit these remittances at a time when the Indian economy is grappling with a host of other problems. In case the situation escalates into a military conflict, this could also spell trouble for thousands of Indians working in the region, who send almost half of India’s foreign remittances. According to a Reserve Bank of India (RBI) study released in 2018, United Arab Emirates, Saudi Arabia, Qatar, Kuwait and Oman, all countries in west Asia, had a share of 53.5% in India’s total remittances in 2016-17.

Chabahar Port

A potential conflict between the US and Iran will also have implications for India’s project to develop the strategic port of Chabahar, central to Indian plans to ferry supplies to war-torn Afghanistan and to access Afghan and Central Asian markets while bypassing Pakistan. The project has so far been protected from US sanctions imposed on Iran thanks to a waiver from the Trump administration in view of its importance for Afghanistan.

The US strike took place barely a week after foreign minister S Jaishankar visited Tehran to review ties, with the two sides agreeing to accelerate development of the India-backed Chabahar project after Washington gave New Delhi what it termed a “narrow exemption” to allow access to landlocked Afghanistan subject to Iran’s Revolutionary Guards Corps not participating in the project. The two sides also agreed to take steps to boost the economic viability of Chabahar following the achievement of political objectives for developing the port. Any conflict between the US and Iran is bound to hamper such plans.

“We recognise that Chabahar potentially plays an important role as a lifeline to Afghanistan. That was the reason that drove the Chabahar exemption, and we continue to support it,” a US official said in December. All that could come under threat if the region collapses into a broader war.

Chabhahar is less than 100km from Gwadar, a Pakistani port developed with Chinese assistance, on which the Islamabad-Beijing axis has pinned its strategic and economic hopes.

Iran was the primary oil supplier to India, but Delhi has had to shut down the spigot under US pressure. The US has now emerged as a principal energy source and US exports to India are poised to cross $8 billion in 2020, accounting for nearly 10 per cent of its buying, while Iranian supply is being whittled down to zero.

Comments

The US and Iran are already facing off over President Donald Trump’s crippling economic campaign against Tehran and suspected Iranian reprisals. Saudi Arabia’s energy facilities as well as foreign tankers in and around the Persian Gulf have been the target of several attacks over the past year – a region that includes OPEC’s five biggest producers.

While the US remains India’s most important strategic partner, India’s so-called civilisational ties with Iran, its quest for an alternative route to central Asia and Afghanistan (bypassing Pakistan) and the fact that the region is home to almost 8 million Indians make it impossible for any Indian government to shun Tehran.

India should no longer sit on the fence and instead use its clout to play a more robust diplomatic role in promoting peace and security in the region.

The US has shown scant regard for the interests of its partners. Trump’s air strike was purely in domestic political context with no consideration for its likely impact on important partners like India.