Introduction

With population of India touching 140 billion and having undergone a rapid and sustained economic expansion in the last 10 years, demand for energy in India is about to see a quantum 40 percent growth in the next ten years. Like many other developing countries of the world, India is also a net importer of energy. More than a quarter of primary energy needs of the country are being met through imports, mainly in the form of crude oil and natural gas. Biofuels, being a domestic and renewable source of energy, can significantly cut down India’s dependence on imported oil, can lessen the environmental degradation caused by the use of fossil fuels and is the best alternative option in securing the energy needs of the country.

India embarked upon the journey of production of bio-fuels nearly a decade ago in order to reduce its dependence on foreign oil and thus, improving her energy security situation. India is now amongst top producers of Jatropha oil and achieved 10% ethanol blending in 2022, quite ahead of the schedule, in its pursuit of a 20% blending target by 2025.

Launch of the Global Bio-Fuel Alliance (GBA)

Headwinds in the area of sustainable development exist, still, Global Greenhouse Gas (GHG) emissions continue to surge with biodiversity loss, climate change, drought, pollution, land degradation and desertification, threatening lives and livelihoods. In order to deal with this current phenomenon, Prime Minister Shri Narendra Modi along with the leaders of Singapore, Bangladesh, Italy, USA, Brazil, Argentina, Mauritius and UAE, launched the Global Biofuel Alliance on 9 September 2023, on the sidelines of the G20 Summit in New Delhi. The alliance is going to act as a central repository of knowledge and databank as well as an expert hub. GBA aims to be a catalyst platform, promoting global collaboration for the widespread adoption and advancement of biofuels.

What are Bio – Fuels?

Any kind of a hydrocarbon fuel that is produced from an organic matter (living or dead) in a short duration (days, weeks, or months), can be called a biofuel. Biofuels can be solid, liquid or gaseous in nature. Solids like Wood, dried plant material, manure, liquid like Bioethanol and Biodiesel and gaseous like Biogas can be used to replace or be used in addition to diesel, petrol or other fossil fuels for transport. They can also be used to produce heat and electricity and have widespread application.

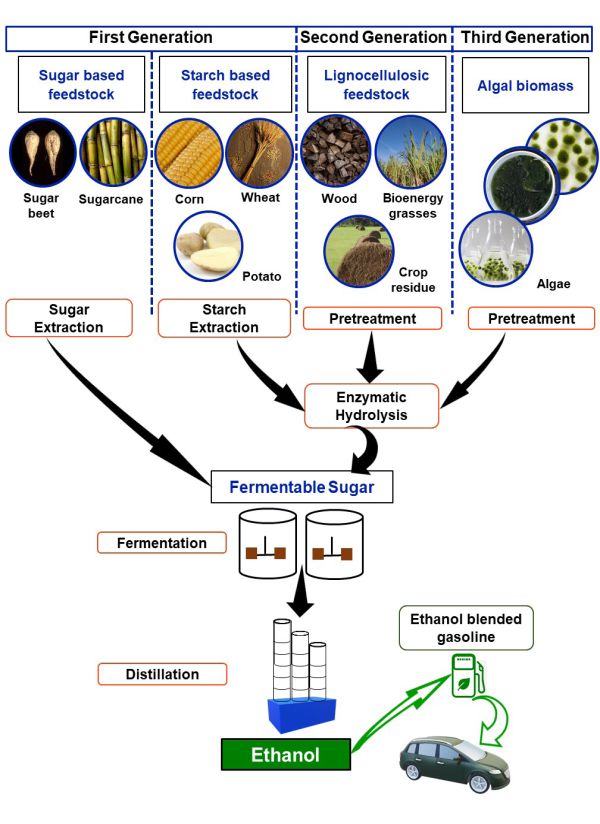

First Generation Biofuels. These are produced from food sources such as starch, sugar, vegetable oil or animal fats using conventional technology. Some of the common first-generation biofuels include Biodiesel, Bioalcohols, Bioethers, Vegetable oil, Biogas etc. Though the process of conversion is easy but use of food sources in the production of biofuels creates an imbalance in food economy, which may lead to increased food prices and hunger.

Second Generation Biofuels. These are made from non-food crops or some portions of food crops that are not edible and are considered as wastes, like stems, husks, wood chips, fruit skins, peelings etc. Thermochemical reactions or biochemical conversion process is used for producing such fuels. Some of the examples include cellulose ethanol, biodiesel etc. These fuels may not have any effect on the food economy, however, their production is quite complicated.

Third Generation Biofuels. These are produced from some micro-organisms like algae, example Butanol. Micro-organisms like algae can be grown using water and land thought unsuitable for food production. One disadvantage is environmental pollution caused due to the use of fertilizers for production of such crops.

Fourth Generation Biofuels. In the production of such fuels, crops that are genetically engineered to consume high amounts of carbon are grown and harvested as biomass. The crops are thereafter converted into fuel using second generation techniques. The advantage is that it reduces carbon from the environment.

Felt Need

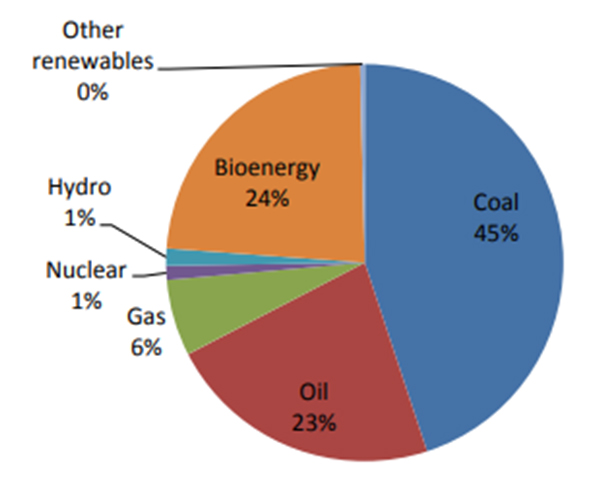

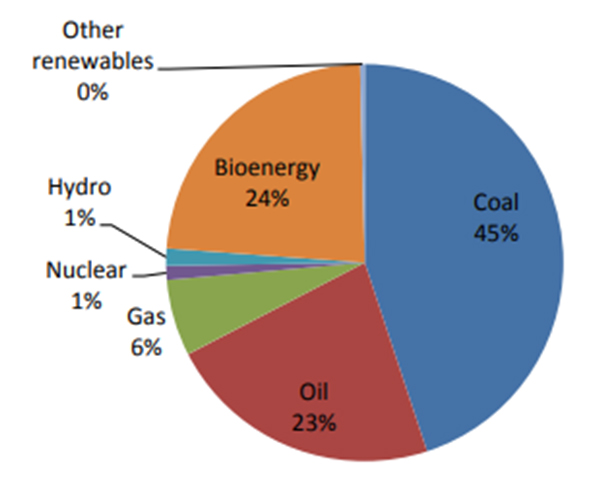

Indian Energy Scenario and Significance of Biofuels. India ranks sixth in energy demand accounting for 3.6% of total global energy demand in the world. While the energy demand is estimated to grow at 4.8% a year, a large part of India’s population, majority in the villages / rural areas, doesn’t have access to it. Most rural kitchens still use biomass fuels in their smoky kitchens.

In 2003-04, India, which is 70% dependent on imports for meeting her crude oil requirement, spent 18.36 billion dollars (Rs 84,236 cores) on the import of more than 90 million tons of crude oil. It is predicted that if the country continues at this rate, 5.6 million barrels of oil /day will be consumed by 2030 out of which, more than 94% will be met through oil imports.

Securing of long-term supply of energy not only requires current fuel resources to be used as economically as possible but also diversification of energy sources used in this fuel system. In the years to come, we have to reach a stage in our development, where our dependence on fossil fuels should reach the minimum level for energy generation. This is the reason why Biofuels are recognized major players for ensuring energy security in the future of our country.

ALSO READ : India is assembling an ace group of cyber sleuths to guard its energy grids

Suitability of India for Bio Fuels Production

Fortunately, there is large proportion of degraded forestland and unused public land and fallow lands of farmers where non-edible oil seeds can be grown. There are many of the non-edible species which are rich in oil and at the same time, can be easily grown in the country. Further, India has large arable land and good climatic conditions with adequate rainfall in the large part of the area to account for large biomass production each year.

Some promising tree species were evaluated and it was found that there were a number of them such as Jatropha Curcas and Pongamia Pinnatta which can be very suitable for our conditions. Jatropha Curcas, in specific, has been found most suitable for the purpose.

One hectare land under Jatropha plantation with about 4400 plants per hectare under rain fed conditions can produce about 1500 litres of oil. It is estimated that about three million hectares plantation is required in order to produce oil for 10% replacement of petrodiesel which is quite substantial.

Biofuel Policy of India

History of Biofuel. India initiated its biofuel programme more than a decade back and launched many policy measures to promote biofuels ever since. India launched its “Ethanol Blending Programme” in 2002, which mandated 5% blending of ethanol (E5) with petrol in four Union Territories and nine States with effect from January 2003. The Planning Commission of India constituted a Committee on Development of Biofuels in July 2002. The report released in 2003 of the Committee recommended India to progressively move towards higher targets in blending of biofuels which include strengthening of the ethanol blending programme.

The 5% blending mandate in the case of ethanol could not be achieved due to shortage of bioethanol supply. In October 2004, the mandate was amended “requiring E5 blends only when adequate ethanol supplies were available”. In 2006, the 5% blending mandate was extended to cover 20 States and 8 Union Territories.

Again, this target could not be achieved due to shortage of bioethanol supply. In September 2008, the Union Cabinet set a target of 5% blending all across the country. The Planning Commission report of year 2003 recommended launching a National Mission on Biodiesel to be based on non-edible oil and identified Jatropha Curcas as the most suitable tree-borne oilseed for this biodiesel production. One aim of the Mission was to gradually raise the blending target to 20% by the year 2012. The Ministry of Petroleum and Natural Gas, in October 2005, announced a biodiesel purchase policy, which required Oil Marketing Companies (OMC) to procure biodiesel for blending with diesel with effect from January 2006. In order to ailing ethanol and biodiesel blending programs, India’s National Biofuel Policy was approved by the Government of India in December 2009.

National Biofuel Policy. The goal of the Policy is to ensure availability of biofuels in the market, thereby, increasing their blending percentage. It aims at ensuring the ready availability of biofuels in the market to meet demand and brought out an indicative target of 20% blending of biofuels, for bio-diesel and bio-ethanol both, by 2017. While the target for bio-ethanol was supposed to be mandatory, the blending target for biodiesel was intended to be recommendatory. Salient features of the biofuel policy include:

1. Biofuels to be based solely on non-food crops to be raised on degraded or wastelands that were found to be unsuitable for agriculture, thereby, avoiding a possible fuel vs. food security conflict.

2. Cultivation of non-edible oil seeds for production of bio-diesel to be promoted through a Minimum Support Price.

3. Plantations that provide the feedstock for biodiesel and bio-ethanol also to be supported through a Minimum Support Price.

4. Research, development and demonstration be supported to cover varied aspects of feedstock production and processing of biofuels which also include development of second-generation biofuels. The Policy document also includes interventions and enabling mechanisms with respect to plantations, processing, distribution and marketing, financing, financial and fiscal incentives and research and development.

G20 Bio-fuel Alliance

Progress in Other G20 Countries. The United States Inflation Reduction Act makes USD 9.4 billion available for biofuels which is quite substantial. Some other G20 countries and regions making notable progress to boost biofuels include:

• Brazil is planning to increase biodiesel blending to 15% by 2026 which is up from 10% in 2022.

• Canada is implementing its Clean Fuel Regulations in 2023, which require a 13% cut in GHG emissions intensity for transport fuels by 2030.

• The European Union is closing on to its agreement on updated Renewable Energy Directive (RED III) which would double the requirements for renewables content in transportation fuels, including biofuels, compared to existing targets.

• Singapore has supplied about 70,000 tonnes of bio-fuels to ocean-going vessels in 2022. Singapore Airlines is also using sustainable blended aviation fuel.

• The Argentina biodiesel industry is based mainly on the use of soybean as feedstock. There are 31 companies in the country currently producing biodiesel with an estimated annual production capacity of over 745 million litres.

Gains for India

G20 initiative was launched to promote an alliance of governments, international organizations and industries to promote adoption of bio-fuels. Global bio-fuel alliance mirrors the International Solar Alliance which was launched in 2015 by India and 120 signatory countries in Paris.

The Bio-fuel alliance is a win-win situation for ‘Atamnirbhar Bharat’. It will help to create jobs, reduce pollution and to top it all, make India a leader in the production and use of Bio-fuels. The alliance is oriented towards India’s goal of becoming a carbon-neutral country by 2070. The alliance will fast-track India’s existing Bio-fuels programs like Sustainable Alternative towards Affordable Transportation (SATAT) and ‘Gobardhan’ scheme, which will help farmers in enhancing their income, create jobs and boost overall growth of Indian ecosystem.

Way Forward

Despite laying a lot of emphasis on Bio-fuels, substantial ground still needs to be covered by India. In order to achieve its laid down aim, India needs to rev up its model of Bio-fuels which requires making policy changes, adopting technological advancements and collaboration with other countries.

Quality Check. National Policy on Biofuels (NPB) does not permit private biofuel manufacturers to market directly. The responsibility for storage, distribution and marketing of Biofuels is vested in OMCs. Biodiesel manufacturers must send their biodiesel to OMC approved collection centers where the standard of quality is verified. Price and minimum quality standards are already laid out in the NPB.

Government Support. Biofuels need to be backed by the government in many different ways, including subsidies, blending mandates or targets, reduced import duties, tax exemptions and credits, support for R&D and direct involvement in biofuel production, as well as other incentives to encourage local biofuel production and use. Biofuel blend mandates require specific quantity of biodiesel, ethanol and advanced biofuels to be mixed with petroleum-based transportation fuels and needs to be vigorously executed.

Innovation. An innovation gap exists in converting woody and grassy biomass (e.g. agricultural and forestry residues) to liquid biofuels. For example, via thermochemical routes such as biomass gasification followed by FT synthesis (bio-FT), hydrothermal liquefaction and fast pyrolysis with upgrading. While bio-FT is presently at the demonstration phase, many commercial-scale projects are currently in the pipeline, mostly in the United States and also in Europe and Japan. G20 alliance will prove beneficial here, wherein, such exchange of ideas and innovations can now take place.

ALSO READ: BEL and Smiths Detection to manufacture high-energy scanning systems

Technology Deployment. The vast quantity of biofuel production currently uses so-called conventional feedstocks such as corn, sugar cane and soybeans. However, extending biofuel production to advanced feedstocks is critical to ensuring minimal impact on food prices, land-use and other environmental factors while tripling biofuels production.

Used cooking oil and waste animal fats provide most of the non-food crop feedstocks for biofuel production currently. Given that these feedstocks are limited, new technologies are required to be commercialised to expand non-food crop biofuel production. Toxicological study should also be initiated in India through concerned R & D centers, as it is a pre-requisite for the introduction of any fuel.

Supporting Infra. Capturing CO2 from biofuels is cheaper as compared to other bioenergy and carbon capture processes. Many of the biofuel production pathways emit CO2 as an inherent part of their process. Such routes include ethanol fermentation (both cellulosic and crop-based) and bio-FT. The high concentration of CO2 essentially means that the cost of capturing the CO2 is low, since no additional purification will be required apart from dehydration. Once the CO2 is captured, it requires to be compressed and transported via a pipeline, truck or ship to a storage site or be used in some way, for which suitable infrastructure needs to be created.

Policy. Biofuels are facing challenges of their own, prompting differing policy responses. Overall, close to 80 countries have policies that support biofuel demand. Nearly 60% of biofuel demand is observed in advanced economies and only 40% in emerging economies. Biofuel demand though, is expected to increase by 11% to 2024, with two-thirds of growth taking place in emerging economies.

However, while biofuels offer energy security advantages, their prices climbed quicker than those of gasoline and diesel in many of the countries. In order to mitigate increase in transport fuel costs, Brazil, Sweden and Finland delayed their planned increase to biofuel blending obligations in 2022.

Only Brazil and Indonesia are accelerating deployment by 2024. India also needs to act on identical lines and bring in changes in its NBP. It may lead to hike in transport prices in the near future but will be immensely beneficial in the long run.

Investment. Investment in liquid biofuels saw a marked hike in 2022, notably in renewable diesel Global transport biofuel, wherein, capacity was enhanced by 7% in 2022, its largest annual increase in over a decade. Biorefineries focused on renewable diesel and contributed towards the bulk of the growth, thanks to attractive policies in the United States and Europe, while ethanol capacity saw notable increases in Brazil, Indonesia, India and China.

Several large companies, world over, are also making forays into sustainable aviation fuels (SAFs). In the European Union alone there are more than 30 advanced biorefinery projects in operation and further 10 are slated for operations before 2025. The United States is seen as a leader in this sector, attributed to generous fiscal incentives, an estimated USD 9.4 billion in tax credits and financial support for new production capacity and biofuel infrastructure.

International Collaboration. International collaboration is inescapable in order to realise the potential of biofuels. International collaboration can accelerate biofuel deployment by developing and sharing best practices, policy and deployment, co-ordinating research and promoting common sustainability standards. Current efforts include:

• The Biofuture Platform Initiative. A 22-country initiative to promote an advanced low-carbon bioeconomy that is innovative and scalable, sustainable, established under the Clean Energy Ministerial in 2021. It aims at promoting consensus on biomass sustainability, enabling financing, promoting best practices and promoting international co-operation.

• IEA Bioenergy. A Technology Collaboration Program (TCP) which was established in 1978 in order to facilitate co-operation and exchange of information between countries that have national programs in bioenergy R&D and deployment. It provides leading analysis on market deployment, bioenergy technology development, demonstration, sustainability and policy frameworks.

• Clean Skies for Tomorrow Coalition. An industry-led coalition working to promote the commercial sale of viable, low-emission SAF, of which biojet kerosene is one type, for broad adoption by industry by 2030.

• Global Bioenergy Partnership. An initiative that focuses on developing countries to support a wide range of activities including national and regional policy making and supporting sustainable practices. This also includes the development and implementation of 24 sustainability indicators.

An inter-play between G20 alliance and these international collaborations which have already provided a headstart to the Bio fuel sector, needs to evolve so that concerted results can be achieved.

Private Sector Participation. Refiners are now increasing their footprints into the biofuels supply chain. Refiners traditionally focused on oil and gas refining and were involved in half of planned capacity additions, including co‐processing facilities, facility conversion or building new facilities. Refiners, such as Total Energies, Eni, Neste and Valero, currently own maximum of operating capacity for renewable diesel and they also have a sizeable share of planned capacity. These refiners need to be dovetailed into own overall design and given incentives, so as to provide much needed fillip to the Bio- Gas sector.

Conclusion

Development of a self-reliant community to manage the natural system is an important element of sustainable development. Here lays the importance of biofuels as a renewable and domestic energy supply. While bioethanol and biodiesel can be seen as future fuels in the transport sector, biogas and biomass technologies can prove their utility in rural India. However, commercialisation of these fuels on a large scale needs technological innovation of the highest order supported by proper policy orientation.

Government of India seems keen to give a head start to all the biofuels programs. A concerted effort from both, the government and private parties, towards a coherent technological and policy initiative has the potential to lead India to meet its energy requirements substantially through biofuels materializing the ‘Swadeshi’ vision of Mahatma Gandhi, thereby, creating revolutionary changes in our nation’s development. New Delhi G20 summit has laid the foundation for this mammoth endeavor, however, it needs to be pursued vigorously in upcoming G20 summits in Brazil in 2024, in South Africa in 2025 and the United States in 2026 at the beginning of the next cycle.