The China-Pakistan Economic Corridor (CPEC) is a massive infrastructure and development project that aims to connect China’s western region to Pakistan’s deep-water port of Gwadar through a network of highways, railways, and pipelines. The project is a part of China’s broader Belt and Road Initiative (BRI) and is expected to cost around $62 billion.

Mystery Over Terms and Conditions

The terms and conditions of the loans and projects being executed by China in Pakistan as part of CPEC have been a subject of controversy and criticism from some quarters. Some of the key concerns include:

• Interest Rates: One of the main concerns is that the loans being provided by China to Pakistan are on high-interest rates. Some estimates suggest that the interest rates are around 5-7%, which is higher than what Pakistan can obtain from international markets.

• Debt Burden: Another concern is that Pakistan’s debt burden is increasing rapidly as a result of the loans being provided by China. Some estimates suggest that Pakistan’s external debt to China could reach around $40 billion by 2025, which could put a strain on Pakistan’s economy and its ability to repay its debts.

• Lack of Transparency: There are also concerns about the lack of transparency in the terms and conditions of the loans being provided by China. Critics argue that the details of the loans and projects being executed under CPEC have not been made public, which makes it difficult to assess their impact on Pakistan’s economy and its people.

• Security Concerns: There are also security concerns surrounding some of the projects being executed under CPEC. For example, the Gwadar port, which is a key component of the project, has been a target of attacks by militants in the past.

Despite these concerns, the Chinese government and the Pakistani government have defended the project and its terms and conditions. They argue that CPEC is a vital project that will help Pakistan address its infrastructure deficit and spur economic growth. They also argue that the project is being executed in a transparent and responsible manner and that the security concerns are being addressed through appropriate measures.

Loan Repayments

The loans given by China for Pakistan’s CPEC projects are typically structured as long-term loans, with a repayment period of 20-25 years. However, the specific terms and conditions of each loan may vary depending on the nature of the project and the agreement between the Chinese and Pakistani governments.

Once a project is completed and starts generating revenue, Pakistan is expected to use that revenue to repay the loans. The repayment schedule is typically designed to be flexible, taking into account the cash flows generated by the project and the economic conditions in Pakistan.

The terms and conditions of the loans and the repayment schedule have been a subject of controversy and criticism about the lack of transparency. Critics argue that the high interest rates and the debt burden associated with the loans could put a strain on Pakistan’s economy and its ability to repay its debts.

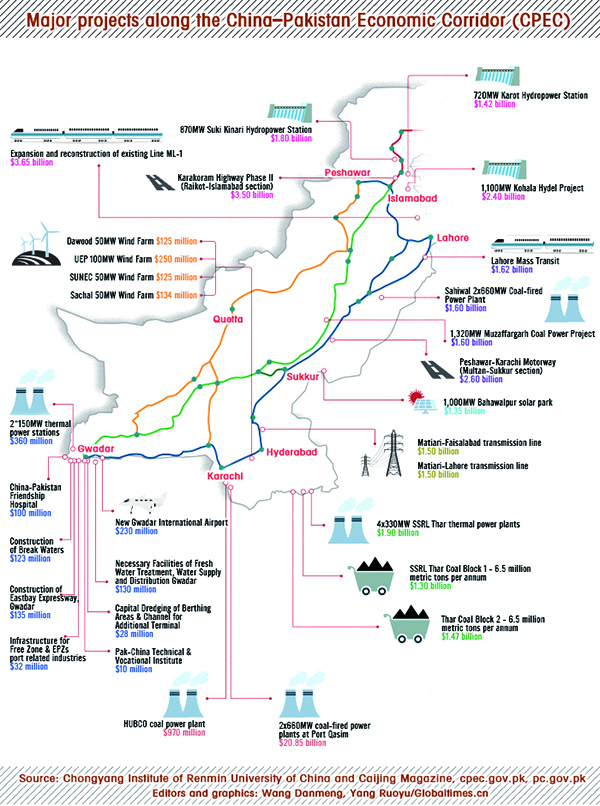

Projects Under CPEC

The following is a list of the major projects that have been proposed or are currently under construction as part of CPEC:

Energy Projects:

- Port Qasim Coal-fired Power Plant (1320 MW)

- Sahiwal Coal-fired Power Plant (1320 MW)

- Engro Thar Coal-fired Power Plant (660 MW)

- Suki Kinari Hydro Power Project (870 MW)

- Kohala Hydropower Project (1100 MW)

- Gwadar Coal-fired Power Plant (300 MW)

- Matiari-Lahore Transmission Line (660 kV)

Infrastructure Projects:

- Gwadar Port and Free Zone

- Havelian-Thakot Motorway (120 km)

- Karachi-Lahore Motorway (1,152 km)

- Karachi Circular Railway (KCR)

- Lahore Orange Line Metro Train (27 km)

- Quetta Mass Transit System

- Multan-Sukkur Motorway (392 km)

- Thakot-Raikot Expressway (136 km)

- Dera Ismail Khan-Zhob Road (210 km)

- Upgradation of Karachi-Lahore-Peshawar Railway Line

- New Gwadar International Airport

- Gwadar Eastbay Expressway (19.5 km)

Industrial and Economic Zones:

- Gwadar Free Zone

- Rashakai Special Economic Zone (1,000 acres)

- Dhabeji Special Economic Zone (1,000 acres)

- Allama Iqbal Industrial City (3,200 acres)

- M-3 Industrial City (4,000 acres)

- ICT Model Industrial Zone, Islamabad (1,000 acres)

- Bostan Industrial Zone (1,000 acres)

Agriculture Projects:

- Modernization of Agriculture Sector

- Development of Fisheries and Fish Processing Plants

- Establishment of Livestock Farms and Meat Processing Plants

- Construction of Water Storage Dams and Irrigation Infrastructure

Telecommunication and IT Projects:

- Cross-border Fiber Optic Cable Network

- Upgradation of PTCL Network

- Construction of Data Centers

Health and Education Projects:

- Upgradation and Construction of Hospitals and Health Centers

- Construction of Universities and Technical Institutes

Note that this is not a comprehensive list and there may be other projects that are part of CPEC or proposed to be included in the future.

Projects Completed

Only a handful of projects under the CPEC have been completed or are near completion. Here are some examples:

• Gwadar Port: The Gwadar port is a key component of CPEC and has been completed. It is a deep-sea port located in southwestern Pakistan and is expected to serve as a gateway for trade between Pakistan, China, and other Central Asian countries.

• Thar Coal Power Project: Located in the Thar desert in Sindh province has been completed and is expected to add 660 megawatts of electricity to the national grid.

• Havelian-Thakot Motorway: A 120-km long highway that connects Havelian in Khyber Pakhtunkhwa province to Thakot in northern Pakistan. It has been completed.

• Lahore Orange Line Metro: A rapid transit system in Lahore, the capital of Punjab province, has been completed.

• Karachi-Lahore Motorway: A 1,152-km long highway that connects Karachi to Lahore. A portion of this motorway has been completed, and the remaining sections are under construction.

Many other projects, including energy projects, highways, railways, and special economic zones, are currently under construction or in the planning stage.

Projects Cancelled

Some projects under the CPEC have faced delays or cancellations due to various reasons, including changes in political priorities, security concerns, financial constraints, and environmental issues. The following are some of the major projects that have been reportedly cancelled or put on hold:

• Diamer-Bhasha Dam: The $14 billion hydroelectric dam project in Gilgit-Baltistan was dropped from the CPEC portfolio in 2018 due to disagreements over funding and ownership between Pakistan and China.

• Karachi Circular Railway (KCR): The $2.4 billion project to revamp the 43-km KCR track in Karachi has been stalled since 2018 due to land acquisition and financial issues.

• Matiari-Lahore Transmission Line: The 878-km high-voltage transmission line project was cancelled in 2018 due to financial constraints.

• New Gwadar International Airport: The $230 million project was reportedly delayed due to security and environmental concerns.

• East Bay Expressway: The 19.5-km expressway project in Gwadar was reportedly halted due to issues related to land acquisition and compensation.

Properties Pledged as Collateral

Pakistan has pledged national or state-owned properties as collateral for loans from foreign countries or organisations, notably from China, as follows:

• Port Qasim coal-fired power plant: For $1.5 billion loan to China’s Exim Bank.

• innah International Airport: For $238 million loan to Asian Development Bank (ADB).

• Islamabad-Lahore Motorway: For $2.5 billion loan to China’s Exim Bank.

• National Highway Authority: For various loans, including $300 million to ADB.

• Gwadar Port: For $10 billion loan to China.

• Karakoram Highway: For $325 million loan to China’s Exim Bank.

• Thar coal-fired power project: For $1.9 billion loan to China’s Exim Bank.

• National Power Parks Management Company: For $700 million loan to China’s Exim Bank.

• Lahore-Sialkot Motorway: For $275 million loan to ADB.

• Pakistan Steel Mills: For $500 million loan to Russia.

• Sukuk bonds: These are Islamic bonds that represent ownership in a tangible asset, as collateral for loans. In 2014, Pakistan issued $1 billion worth of Sukuk bonds and pledged them as collateral for a $1.5 billion loan from China’s Exim Bank.

Pledging of national or state-owned properties as collateral for loans can have economic and political implications, as it can lead to a loss of sovereignty and control over key assets.